How do you calculate product cost template?

Product Cost = Direct Material Cost + Direct Labor Cost + Manufacturing Overhead Cost

- Product Cost = $1,000,000 + $350,000 + $38,000.

- Product Cost = $1,388,000.

How do I create a cost sheet in Excel?

How to Create Cost & Expense Sheets in Excel

- Open a blank Microsoft Excel spreadsheet. …

- Write down the necessary categories for your spreadsheet. …

- Type the date in the first column on the Excel spreadsheet.

- Type a column for the “Payee” of the costs and expenses next to the “Date” column.

How do you calculate product cost?

Product Cost per Unit Formula = (Total Product Cost ) / Number of Units Produced.

What is a costing template?

Costing templates contain the procedures you or your manufacturing supplier use to manufacture parts. The template can include customized information such as material cost and thicknesses, cost of manufacturing operations, and manufacturing setup costs.

What are examples of product costs?

Examples of product costs are direct materials, direct labor, and allocated factory overhead. Examples of period costs are general and administrative expenses, such as rent, office depreciation, office supplies, and utilities.

What is cost of production PDF?

A firm’s cost of production includes all the opportunity costs of making its output of goods and services. • Explicit and Implicit Costs •A firm’s cost of production include explicit costs and implicit costs. • Explicit costs are input costs that require a direct outlay of money by the firm.

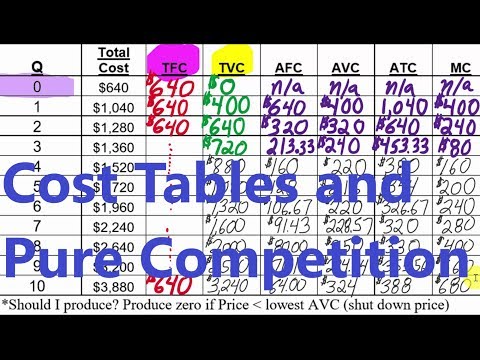

How do you make a cost table?

How do you prepare a production cost statement?

Add the opening stock of the finished inventory to the cost of goods manufactured to give the cost of goods available for sale. Subtract the closing balance of the finished inventory at the end of the accounting period from the cost of goods available for sale. This is the cost of goods sold.

What is the formula for calculating cost of sales?

To calculate the cost of sales, add your beginning inventory to the purchases made during the period and subtract that from your ending inventory. To calculate the total values of sales, multiply the average price per product or service sold by the number of products or services sold.

What are the 3 product costs?

The three general categories of costs included in manufacturing processes are direct materials, direct labor, and overhead.

What is the formula for total cost in Excel?

How to total columns in Excel with AutoSum

- Navigate to the Home tab -> Editing group and click on the AutoSum button.

- You will see Excel automatically add the =SUM function and pick the range with your numbers.

- Just press Enter on your keyboard to see the column totaled in Excel.

What is the format of cost sheet?

Method of Preparation of Cost Sheet

| Step I | Prime Cost = Direct Material Consumed + Direct Labour + Direct Expenses Direct Material= Material Purchased + Opening stock of raw material-Closing stock of raw material. |

|---|---|

| Step IV | Total Cost = Cost of Production + Selling and Distribution Overheads |

| Profit | Sales – Total Cost |

How do you price and cost?

How to Calculate Selling Price Per Unit

- Determine the total cost of all units purchased.

- Divide the total cost by the number of units purchased to get the cost price.

- Use the selling price formula to calculate the final price: Selling Price = Cost Price + Profit Margin.

How do you calculate ingredients?

To calculate the cost of ingredient used, for each ingredient:

- divide the ‘Cost of quantity purchased’ by the ‘Quantity purchased’;

- then multiple by ‘Quantity needed in recipe’.

How do you make a cost?

How To Do Recipe Costing?

- Write down the Ingredients and Their Quantities. Make a list of all ingredients used in the recipe and state what the weight and measurement of each component used. …

- Fill In Prices For The Ingredients. …

- Calculate the Prices of the Partial Items. …

- Add It All Together. …

- Extract the Cost Of Each Serving.

What are the 3 classifications of costs?

So basically there are three broad categories as per this classification, namely Labor Cost, Materials Cost and Expenses. These heads make it easier to classify the costs in a cost sheet.