Which account is used with a periodic inventory system?

Under periodic inventory systems, a temporary account, Purchase Returns and Allowances, is updated. Purchase Returns and Allowances is a contra account and is used to reduce Purchases.

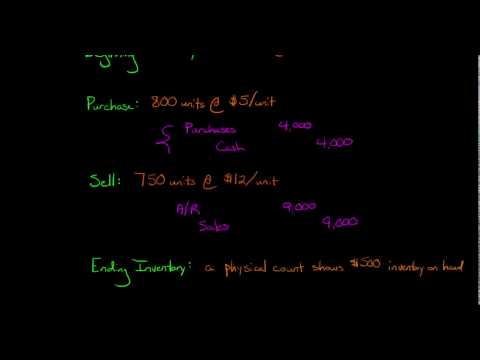

What happens under the periodic inventory system?

Under the periodic inventory system, all purchases made between physical inventory counts are recorded in a purchases account. When a physical inventory count is done, the balance in the purchases account is then shifted into the inventory account, which in turn is adjusted to match the cost of the ending inventory.

Where are purchase discounts recorded under periodic inventory system?

Record the purchase of inventory in a journal entry by debiting the purchase account and crediting accounts payable. Record the purchase discount by debiting the accounts payable account and crediting the purchase discount account.

How is a purchase return recorded in a periodic system?

Record the purchase returns by debiting the accounts payable or accounts receivable account and crediting the purchase returns account. Record inventory sales by crediting the accounts receivable account and crediting the sales account.

What is periodic inventory system example?

One example of a business that would use a periodic system is a food bank. They would frequently count the physical inventory to determine the closing inventory quantity.”

What is a periodic inventory system quizlet?

The periodic system uses a temporary Purchases account that accumulates the cost of all purchase transactions during each period. Purchase discount. The periodic system uses a temporary Purchase Discounts account that accumulates discounts taken on purchase transaction during the period.

How do you do periodic inventory?

Why is the periodic inventory system important?

An advantage of the periodic inventory system is that there is no need to have separate accounting for raw materials, work in progress, and finished goods inventory. All that is recorded are purchases.

What type of account is purchase discounts?

Purchase Discounts is a contra expense account with a credit balance that records the value of purchase cost deductions granted by a seller if a buyer makes a payment within an allowable time period, used as an incentive to encourage prompt payment of invoices.

How are purchase discounts recorded?

Accounting for the Discount Allowed and Discount Received Thus, the net effect of the transaction is to reduce the amount of gross sales. When the buyer receives a discount, this is recorded as a reduction in the expense (or asset) associated with the purchase, or in a separate account that tracks discounts.

How do you record discounted inventory purchases?

Gross Method If the payment is made within the discount period, the buyer will record the payment by debiting accounts payable for the gross price, crediting cash for the difference of gross price and discount received and crediting purchase discounts for the discount received.

What is purchase and purchase return?

When a business makes a purchase of goods that it trades in, the entry for the same is passed through a purchases book. The corresponding entries for the same are passed in the purchase return book, in case such goods are later returned.

Are purchase discounts included in inventory?

Purchase Discounts is also a general ledger account used by a company purchasing inventory goods and accounting for them under the periodic inventory system.

What type of account is purchase returns?

Purchase returns is a nominal account. Generally, purchase returns show zero or unfavorable balance (Credit balance). It can also be termed as a contra-expense account as purchase returns reduce our purchase expenses.

What is perpetual inventory system and periodic inventory system?

The periodic inventory system uses an occasional physical count to measure the level of inventory and the cost of goods sold. The perpetual system keeps track of inventory balances continuously, with updates made automatically whenever a product is received or sold.

When using the periodic inventory system What is a physical inventory count used to determine?

When using the periodic system, the physical inventory count is used to determine c) both the cost of goods sold and the cost of ending inventory.

What is inventory system in accounting?

Accounting for inventory is the system that counts and records changes in the value of stock such as raw materials, WIP and finished goods, which are all considered assets. Financial accounting for inventory provides an accurate valuation of these stock assets.