How do you calculate cost of goods manufactured on an income statement?

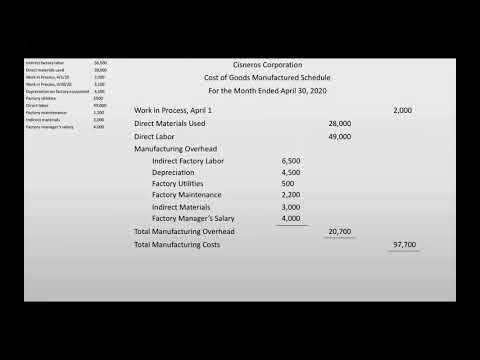

How Do We Calculate Cost of Goods Manufactured? To calculate the cost of goods manufactured, you must add your direct materials, direct labor, and manufacturing overhead to get your businesses’ total manufacturing cost.

Why is cost of goods manufactured on the income statement?

The cost of goods manufactured schedule is used to calculate the cost of producing products for a period of time. The cost of goods manufactured amount is transferred to the finished goods inventory account during the period and is used in calculating cost of goods sold on the income statement.

What is calculated in the statement of goods manufactured?

What Does Cost of Goods Manufactured Mean? The cost of goods manufactured equation is calculated by adding the total manufacturing costs; including all direct materials, direct labor, and factory overhead; to the beginning work in process inventory and subtracting the ending goods in process inventory.

What is included in the cost of goods sold for a manufacturer?

Definition of Cost of Goods Sold-COGS The cost of goods sold (COGS) is the sum of all the direct costs of a product that a manufacturer, trader or distributor has sold. The direct cost includes the cost of material, labor and other costs which are directly are directly associated with the manufacturing of the product.

What is the difference between COGM and COGS?

Cost of goods manufactured are the production costs incurred on finished goods produced in a specific accounting period. Cost of goods sold are the production costs incurred on goods actually sold in a specific accounting period.

How do you find COGS on a balance sheet?

How to Calculate Cost of Goods Sold. The cost of goods sold formula, also referred to as the COGS formula is: Beginning Inventory + New Purchases – Ending Inventory = Cost of Goods Sold. The beginning inventory is the inventory balance on the balance sheet from the previous accounting period.

How do you schedule a cost of goods manufactured?

What is the difference between COGS and expenses?

The difference between these two lines is that the cost of goods sold includes only the costs associated with the manufacturing of your sold products for the year while your expenses line includes all your other costs of running the business.

Does cost of goods manufactured include period costs?

Cost of Goods Manufactured (COGM) is a term used in managerial accounting that refers to a schedule or statement that shows the total production costs. It not only includes the cost of materials and labor, but also both for a company during a specific period of time.

Is COGS on the balance sheet or income statement?

COGS counts as a business expense and affects how much profit a company makes on its products. Cost of goods sold is found on a business’s income statement, one of the top financial reports in accounting. An income statement reports income for a certain accounting period, such as a year, quarter or month.

Is COGS an asset or liability?

COGS is a type of expense. Expenses are costs your business incurs during operations. When you create a COGS journal entry, increase expenses with a debit, and decrease them with a credit.

How do you record cost of goods sold in accounting?

When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference between your COGS Expense and Purchases accounts. Your COGS Expense account is increased by debits and decreased by credits.

What is FOH in accounting?

Factory overhead is the costs incurred during the manufacturing process, not including the costs of direct labor and direct materials.