How do you calculate FIFO problems?

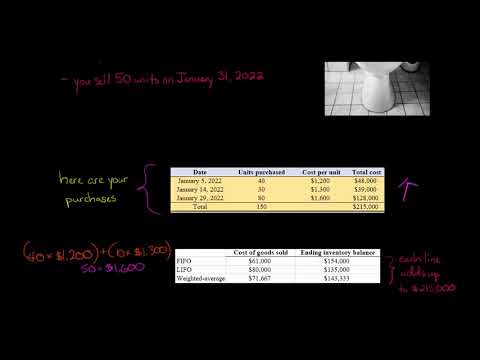

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

What is LIFO FIFO with example?

FIFO (“First-In, First-Out”) assumes that the oldest products in a company’s inventory have been sold first and goes by those production costs. The LIFO (“Last-In, First-Out”) method assumes that the most recent products in a company’s inventory have been sold first and uses those costs instead.

How do you calculate FIFO average?

What is an example of LIFO?

Example of LIFO that buys coffee mugs from wholesalers and sells them on the internet. One Cup’s cost of goods sold (COGS) differs when it uses LIFO versus when it uses FIFO. In the first scenario, the price of wholesale mugs is rising from 2016 to 2019.

What is FIFO example?

Example of FIFO Imagine if a company purchased 100 items for $10 each, then later purchased 100 more items for $15 each. Then, the company sold 60 items. Under the FIFO method, the cost of goods sold for each of the 60 items is $10/unit because the first goods purchased are the first goods sold.

What’s the FIFO method?

FIFO stands for “First-In, First-Out”. It is a method used for cost flow assumption purposes in the cost of goods sold calculation. The FIFO method assumes that the oldest products in a company’s inventory have been sold first. The costs paid for those oldest products are the ones used in the calculation.

How do you calculate cost of goods sold using FIFO?

The First-in First-out (FIFO) method of inventory valuation is based on the assumption that the sale or usage of goods follows the same order in which they are bought….For the sale of 250 units:

- 100 units at $2/unit = $200 in COGS.

- 100 units at $3/unit = $300 in COGS.

- 50 units at $4/unit = $200 in COGS.

Is it first in last out or last in first out?

FIFO (first in, first out) inventory management seeks to sell older products first so that the business is less likely to lose money when the products expire or become obsolete. LIFO (last in, first out) inventory management applies to nonperishable goods and uses current prices to calculate the cost of goods sold.

What company uses FIFO?

Just to name a few examples, Dell Computer (NASDAQ:DELL) uses FIFO. General Electric (NYSE:GE) uses LIFO for its U.S. inventory and FIFO for international. Teen retailer Hot Topic (NASDAQ:HOTT) uses FIFO.

How do you calculate net income from FIFO?

How do you calculate gross profit using FIFO?

For example, suppose a company’s oldest inventory cost $200, the newest cost $400, and it has sold one unit for $1,000. Gross profit would be calculated as $800 under LIFO and $600 under FIFO.

How does FIFO costing work?

What is FIFO costing? In simplest terms, FIFO (first-in, first-out) costing allows you to track the cost of an item/SKU based on its cost at purchase order receipt, and apply this cost against each shipment of the item until the receipt quantity is exhausted.

Does Nike use FIFO?

Inventories are valued on a Ñrst-in, Ñrst-out (FIFO) basis. During the year ended May 31, 1999, the Company changed its method of determining cost for substantially all of its U.S. inventories from last-in, Ñrst-out (LIFO) to FIFO. See Note 11.

Do grocery stores use LIFO or FIFO?

FIFO—First-In, First-Out This is a standard method at grocery stores and other similar suppliers where products will deteriorate or expire with age. It could be summed up as selling or shipping the oldest items first before any newer items.

Why do restaurants use FIFO?

FIFO helps food establishments cycle through their stock, keeping food fresher. This constant rotation helps prevent mold and pathogen growth. When employees monitor the time food spends in storage, they improve the safety and freshness of food. FIFO can help restaurants track how quickly their food stock is used.

Is milk a FIFO?

As its name implies, FIFO assumes the first inventory manufactured or purchased during a period is sold first, while the inventory manufactured or produced last is sold last. It’s kind of like milk in a grocery store. The milk the store buys first is pushed to the front of the shelf and sold first.