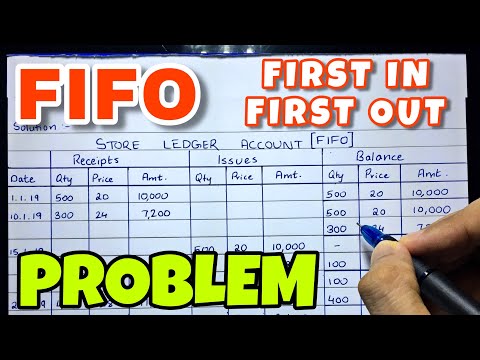

How do you make a store ledger account using FIFO?

What is the format of FIFO?

First In, First Out (FIFO) is an accounting method in which assets purchased or acquired first are disposed of first. FIFO assumes that the remaining inventory consists of items purchased last. An alternative to FIFO, LIFO is an accounting method in which assets purchased or acquired last are disposed of first.

How do I create a FIFO account?

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

How do you record inventory using FIFO?

The FIFO method records the first items purchased as the items that were sold, and the last items purchased are the ones listed as inventory on hand.

- Record the amount of inventory on hand at the beginning of the period. …

- Record the amount and dates of inventory purchased, as well as the price of each shipment.

How is FIFO implemented in stores?

To implement the FIFO method, you must load the goods on one side and unload them on the other.

- Carton Flow picking system:

- High-density live storage system for boxes and light products. The product moves along rollers from the loading to the unloading area.

How do you calculate FIFO perpetual inventory?

What is a store ledger?

Definition of stores ledger : a perpetual inventory record especially of raw materials and manufacturing supplies.