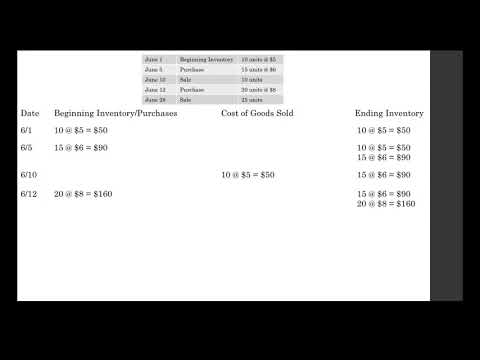

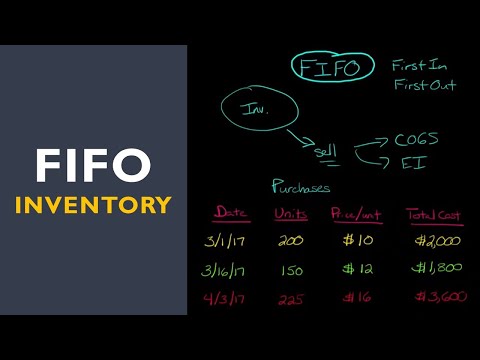

How do you calculate perpetual inventory in FIFO?

What is FIFO method with example?

Example of FIFO Imagine if a company purchased 100 items for $10 each, then later purchased 100 more items for $15 each. Then, the company sold 60 items. Under the FIFO method, the cost of goods sold for each of the 60 items is $10/unit because the first goods purchased are the first goods sold.

How do you use perpetual FIFO?

With perpetual FIFO, the first (or oldest) costs are the first removed from the Inventory account and debited to the Cost of Goods Sold account. Therefore, the perpetual FIFO cost flows and the periodic FIFO cost flows will result in the same cost of goods sold and the same cost of the ending inventory.

What is an example of a perpetual inventory system?

The most common perpetual inventory system example is the usage of wireless barcode scanners in a grocery store. It records all scanned transactions on the system immediately as they occur. This way, firms can easily compute the current and required stockpile.

How do I calculate perpetual inventory?

You can calculate COGS by adding the total cost column in the sales category, or $2,000 + 6,000 + $3,900 = $11,900. Finally, you can calculate the gross profit as the total retail sales minus the costs of goods sold, or $25,000 – $11,900 = $13,100.

How do you calculate cost of goods sold and ending inventory using FIFO?

What is LIFO and FIFO with example?

First-in, first-out (FIFO) assumes the oldest inventory will be the first sold. It is the most common inventory accounting method. Last-in, first-out (LIFO) assumes the last inventory added will be the first sold. Both methods are allowed under GAAP in the United States. LIFO is not allowed for international companies.