How do you calculate ending cost of inventory using FIFO?

To calculate COGS (Cost of Goods Sold) using the FIFO method, determine the cost of your oldest inventory. Multiply that cost by the amount of inventory sold. Please note: If the price paid for the inventory fluctuates during the specific time period you are calculating COGS for, that must be taken into account too.

How do you calculate the cost of ending inventory?

The basic formula for calculating ending inventory is: Beginning inventory + net purchases – COGS = ending inventory.

How do you find cost of ending inventory under LIFO?

How do you calculate cost of goods sold using the FIFO periodic inventory method?

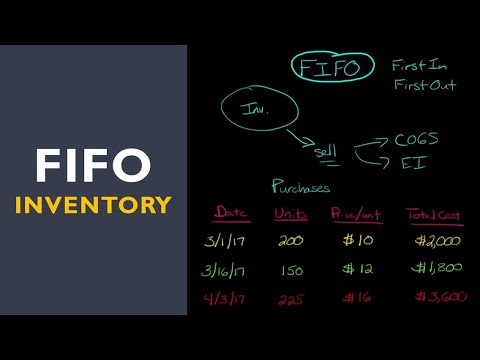

What is FIFO method with example?

Example of FIFO Imagine if a company purchased 100 items for $10 each, then later purchased 100 more items for $15 each. Then, the company sold 60 items. Under the FIFO method, the cost of goods sold for each of the 60 items is $10/unit because the first goods purchased are the first goods sold.

What is the FIFO method?

FIFO stands for “First-In, First-Out”. It is a method used for cost flow assumption purposes in the cost of goods sold calculation. The FIFO method assumes that the oldest products in a company’s inventory have been sold first. The costs paid for those oldest products are the ones used in the calculation.

How do you calculate ending inventory without purchases?

How do you find ending inventory without the cost of goods sold? Ending inventory = cost of goods available for sale less the cost of goods sold.

How do you calculate beginning inventory and ending inventory?

The beginning inventory formula is simple:

- Beginning inventory = Cost of goods sold + Ending inventory – Purchases.

- COGS = (Previous accounting period beginning inventory + previous accounting period purchases) – previous accounting period ending inventory.