How do you compute net income for a merchandiser quizlet?

A merchandiser earns net income by buying and selling merchandise. How do you compute net income for a merchandiser. Net sales – cost of goods sold – other expenses.

How income is measured in a merchandising company?

Income measurement for a merchandising company differs from a service company as follows: (a) sales are the primary source of revenue and (b) expenses are divided into two main categories: cost of goods sold and operating expenses. 5.

How do you find net sales in merchandising?

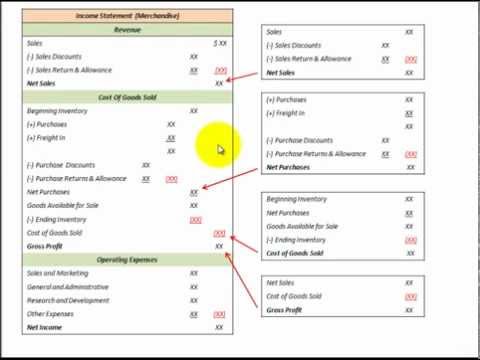

There are three calculated amounts on the multi-step income statement for a merchandiser – net sales, gross profit, and net income.

- Net Sales = Sales – Sales Returns – Sales Discounts.

- Gross Profit = Net Sales – Cost of Merchandise Sold.

- Net Income = Gross Profit – Operating Expenses.

What are the steps of the operating cycle for a merchandiser with credit sales?

An operating cycle consists of lead time, production time, sales time, delivery time, and cash-collection time.

How does income measurement differ between a merchandiser and a service company?

A merchandising company determines its net income by subtracting both its operating expenses and its costs of goods sold from its revenue. While service companies can wait for months to see the revenues from their transactions, most merchandising companies realize their revenues immediately during the transaction.

How do you write a merchandise income statement?

Is the measurement of net income for a merchandising company same as service company?

Yes, the measurement of the net income for a merchandising company and the service company is conceptually the same, because the net income (loss) for…

What is the formula of net sales?

Net sales = Gross sales – Returns – Allowances – Discounts Gross sales is calculated by multiplying the total units sold by the sale per unit price.

What is the difference between net income and net sales?

Net Sales is the company’s sales net of discounts, allowances and returns. Net Income is the actual income of the company earned during a particular accounting period. Net Sales is not dependent on Net Income.

How do you record merchandising transactions?

What is the main source of income in merchandising business?

The primary source of revenues for merchandising companies is the sale of merchandise, often referred to simply as sales revenue or sales.

What is the main source of revenue in a merchandising business?

In a merchandising company, the primary source of revenues is the sale of merchandise, referred to as sales revenue or sales.

Does merchandising business have a service income account?

Merchandising Income Statement Service-based businesses don’t carry inventory and therefore don’t use this account. For a merchandising company, cost of goods sold or COGS is an expense account that refers to the cost of purchasing the inventory and shipping it to the appropriate locations for selling to customers.

How do you prepare an income statement for a service company?

How to Write an Income Statement

- Pick a Reporting Period. …

- Generate a Trial Balance Report. …

- Calculate Your Revenue. …

- Determine Cost of Goods Sold. …

- Calculate the Gross Margin. …

- Include Operating Expenses. …

- Calculate Your Income. …

- Include Income Taxes.

How does the income statement of a merchandiser differ from a service company quizlet?

How does the income statement of a merchandiser differ from a service company? A. A merchandiser reports gross profit while a service company does not.