How much do owner-operators spend on maintenance?

Maintenance costs are generally estimated to be around 10% of total costs and typically run $0.10–$0.15 per mile. These can vary a lot, depending on things like: the age of the truck, the make and model of the truck, individual maintenance decisions, and the quality of the maintenance.

How much should an owner-operator pay himself?

A good rule of thumb can be around 1/3 of the gross earnings for an owner operator’s wage paid to himself.

Is it worth going owner-operator?

Owner operators generally earn higher per-mile rates than company drivers, or a percent-of-load rate. Although they make more income per load, they also must pay all the expenses of operating a truck and business.

Do owner-operators pay for their own gas?

Owner-operators: An owner-operator, who is usually an independent contractor, traditionally pays for fuel out of his or her own wallet, making saving money at the diesel pump very important. For many owner-operators, fuel expenses become part of their daily overhead.

What can owner-operators write off?

Owner-operators can usually deduct the following expenses: trucking-industry and business-related subscriptions, association dues, computers and software, Internet service, cleaning supplies, business interest, office supplies, DOT physicals, drug testing, sleep apnea studies, postage and other business-related …

Why do owner-operators Fail?

When talking about Owner Operators and why they fail, the traditional conception is that there was too much debt or not enough working capital. While this is certainly an issue, there are as many underfunded O/O’s that have made it and many debt free drivers that have lost everything.

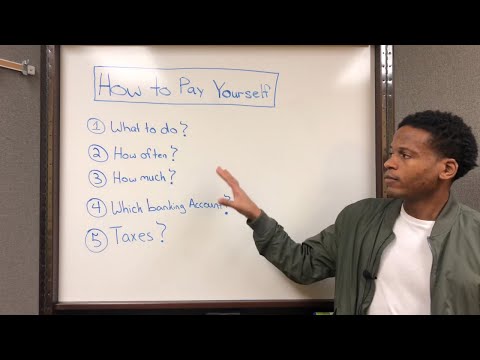

How do I pay myself as an owner-operator?

Which is the single largest expense for operating a truck?

Fuel. Fuel costs are the largest expense for most owner-operators. On average, you may spend between $30,000 and $60,000 a year on fuel. The easiest way to figure out how much you can expect to spend on fuel is by calculating your truck’s average cost per mile.

Is buying an 18 wheeler a good investment?

Is owning a semi-truck profitable? Like all big purchases, buying an 18-wheeler can be a good investment as long as you put in the work ahead of time to make sure you’re making the best financial decision for your business.

How much do truck owners make per month?

Owner Operator Truck Driver Salary

| Annual Salary | Monthly Pay | |

|---|---|---|

| Top Earners | $383,000 | $31,916 |

| 75th Percentile | $331,000 | $27,583 |

| Average | $235,233 | $19,602 |

| 25th Percentile | $144,500 | $12,041 |

How much does a local owner-operator make?

While ZipRecruiter is seeing annual salaries as high as $386,500 and as low as $29,000, the majority of Local Owner Operator Truck Driver salaries currently range between $94,000 (25th percentile) to $272,500 (75th percentile) with top earners (90th percentile) making $359,500 annually across the United States.

What trucking company pays the most for owner-operators?

The trucking company that pays owner-operators the most is Covenant Transport and CRST Expedited. While the average truck driver pay per mile is between 28 and 40 cents per mile, owner-operator truck drivers at these companies earn between $1.50 and $1.60 per mile.

How much can you make owning a 18 wheeler?

An owner operator may take home around $2000-$5000+ weekly, while an investor can make a profit of $500-$2000+ per truck weekly. However, there are many factors that affect profitability. Here you will find a rough estimate of earnings based on average market rates and expense values. and the type of operations.

How much should owner-operators charge per mile?

As of July 2021, trucking rates per mile remain steady. Here are the current rates for the most popular freight truck types: Overall average van rates vary from $2.30 – 2.86 per mile. Reefer rates are averaging $3.19 per mile, with the lowest rates being the Northeast at $2.47 per mile.

Do truck drivers get a meal allowance?

Self-employed truck drivers may also deduct 80% of the special standard meal allowance rate or their actual expenses. The 2018 special standard meal allowance is $63/full day within the US, $68/full day outside the US, $47.25/partial day within the US, $51/partial day outside the US.

How much should owner-operators set aside for taxes?

Generally, owner-operators should set aside 25% to 30% of their weekly net income to pay quarterly taxes. That way, you have money saved and set aside for taxes, and you can avoid surprise tax bills down the road. Failing to pay your taxes each quarter results in penalties.

Do owner-operators get a tax refund?

Q: Do owner-operators receive a tax return? A: Most commonly, no, owner-operators do not receive a tax return. If an owner-operator does receive an income tax refund, it may mean they paid more on their quarterly taxes throughout the year.

Can a truck driver deduct cell phone?

Like your cell phone plan, you can deduct the full cost of any phone, laptop, tablet, or other electronic device that you use only for work. If you use it for both business and personal reasons, you can deduct the portion related to work.