What is sold merchandise in accounting?

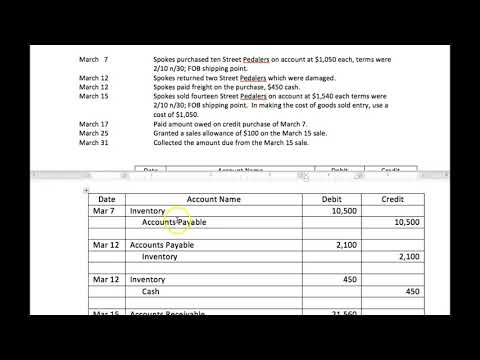

When merchandise is sold, two journal entries are recorded. This is the journal entry to record sales revenue. Because the merchandise is sold on account, accounts receivable balance increases. This is the journal entry to record the cost of sales.

How do you record merchandise journal entries?

Is merchandise sales a debit or credit?

If a customer returns merchandise before remitting payment, the company would debit Sales Returns and Allowances and credit Accounts Receivable or Cash. The company may return the merchandise to their inventory by debiting Merchandise Inventory and crediting COGS.

How do you record cost of merchandise sold?

Your cost of goods sold record shows you how much you spent on the products you sold. To calculate this amount, you multiply the number of products you sold by the cost it took to make or purchase these products. Your journal entry has you debiting the cost of goods sold account and crediting your inventory account.

How do you Journalize sold merchandise for cash?

A sales journal entry records the revenue generated by the sale of goods or services….In the case of a cash sale, the entry is:

- [debit] Cash. Cash is increased, since the customer pays in cash at the point of sale.

- [debit] Cost of goods sold. …

- [credit] Revenue. …

- [credit]. …

- [credit] Sales tax liability.

What kind of journal records sales of merchandise on account?

If it is a credit sale (also known as a sale on account), it is recorded in the sales journal. If it is a credit purchase (also known as a purchase on account), it is recorded in the purchases journal.