How is equivalent pay calculated?

Say your employee earns $50,000 a year, and she works a 40-hour week, her hourly pay is the annual amount divided by 2,080 hours (50,000/2,080 = 24.038, which you can round up to 24.04). For the employee’s daily rate of pay, simply multiply 24.04 by the number of hours worked each day.

How much salary in us is equivalent to India?

So if you are drawing a salary of USD 100,000 in the US, you can expect to draw Rs 21 lakh in India, give or take. At an exchange rate of Rs 45, that would translate to an Indian salary of USD 46,666 or 46% of the US salary.

How do I work out my full-time equivalent salary UK?

What is a good salary in UK?

According to the ONS, in 2020 the average UK salary was £38,600 for a full-time role and £13,803 for part-time role. This is an increase from their 2019 figures, which placed the average UK wage for a full-time role at £36,611 and part-time at £12,495.

What is a notional salary?

The term ‘notional payment’ applies to a range of payments made to employees that are not in the form of cash but which must be treated as cash for purposes of pay as you earn (PAYE) and National Insurance contributions (NICs).

How is basic salary calculated?

Ideally, they use a reversed calculation method where a percentage of the salary and CTC is taken. The basic pay is usually 40% of gross income or 50% of an individual’s CTC. Basic salary = Gross pay- total allowances (medical insurance, HRA, DA, conveyance, etc.)

Is 45 lakhs good salary in India?

Rs. 45 Lakh/year is Rs 262500 per month after taxes! It’s quite a good salary for Bangalore but not great, especially if you are moving from a 80 Lakh bracket!

What is a good salary in USA?

According to the census, the median household income in 2020 was $67,521. A living wage would fall below this number while an ideal wage would exceed this number. Given this, a good salary would be $75,000.

Is USA more expensive than India?

Cost of living in United States is 219% more expensive than in India.

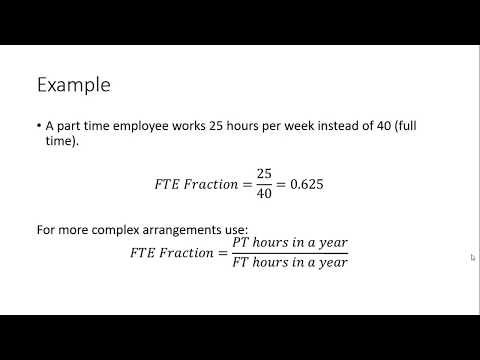

How do you calculate a full-time equivalent?

The calculation of full-time equivalent (FTE) is an employee’s scheduled hours divided by the employer’s hours for a full-time workweek. When an employer has a 40-hour workweek, employees who are scheduled to work 40 hours per week are 1.0 FTEs. Employees scheduled to work 20 hours per week are 0.5 FTEs.

What is the full-time equivalent salary?

Wage in full-time equivalent (FTE) is a wage converted to a full-time throughout the full year, regardless of the actual workload.

How do you work out someone’s full-time equivalent?

To obtain the full time Equivalent for a month, divide the total number of hours by 173.33 (2,080 hours / 12 months). To find the equivalent of a full-time day, divide the total number of hours by 8. The result is the full-time equivalent of 9.04.

Is 40000 GBP a good salary?

It’s a very decent salary in the UK. The average total salary for a family with two working adults is £40,000. £50,000 gross will bring you 67% above average income. Hence, you are well off by at least 67% more.

What salary is middle class UK?

In the year ending March 2019, the average (median) annual household income in each quintile before housing costs were paid was: top quintile: £54,000. second highest quintile: £35,700. middle quintile: £26,800.

Is 22k a good salary UK?

£22k is indeed a decent salary, but not a life of luxury.

How do you calculate notional?

To calculate the notional value of a futures contract, the contract size is multiplied by the price per unit of the commodity represented by the spot price. Notional value helps investors understand and plan for risk of loss.

What is notional income UK?

Notional income is income that you’re treated as having which you may not in fact have. Include. Notes. Trust income that under Income Tax rules is treated as the income of another person. For example, investment income of a child where you’ve provided trust funds of more than £100.

What is notional salary Australia?

Notional Salary means the rates of emoluments which a teacher would have received from time to time if he had continued to be employed in the post which he held immediately before the date of reorganisation and if the reduction in his emoluments had not taken place.