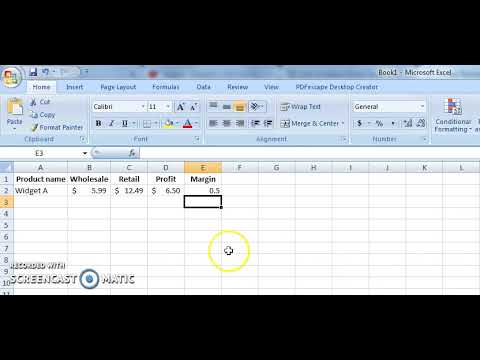

How do I calculate profit in Excel?

To get your profit percentage, enter the percentage formula for Excel “=a2-b2” into the c2 Profit cell. Once you have calculated the profit amount, drag the corner of the cell to include the rest of your table.

How do you calculate the profit of a product?

The gross profit on a product is computed as follows:

- Sales – Cost of Goods Sold = Gross Profit.

- Gross Profit / Sales = Gross Profit Margin.

- (Selling Price – Cost to Produce) / Cost to Produce = Markup Percentage.

How do you calculate profit template?

Profit Margin = (Net Income/ Net Sales) x 100

- Profit Margin = (100,000 / 10,00,000) x 100.

- Profit Margin = 10%

How do you calculate profit on sheets?

Profit is gross sales minus out-of-pocket costs. …then subtract costs from sales. Press enter, and drag to copy the formula down the column. To make your spreadsheet easier to read as it gets larger and more complex, try freeze cells.

How do you calculate profit from selling price?

When the selling price and the cost price of a product is given, the profit can be calculated using the formula, Profit = Selling Price – Cost Price. After this, the profit percentage formula that is used is, Profit percentage = (Profit/Cost Price) × 100.

How do you calculate profit from cost price and selling price in Excel?

How much profit does a product make?

You may be asking yourself, “what is a good profit margin?” A good margin will vary considerably by industry, but as a general rule of thumb, a 10% net profit margin is considered average, a 20% margin is considered high (or “good”), and a 5% margin is low.

How do I calculate profit and loss in Excel?

We can use the following general mathematics formula to determine percent profit or loss:

- = (Gain or loss/previous value*100)

- =D5-C5.

- =E5/C5.

- =(D5-C5)/C5.

- =IF(D5=C5,”No profit,No loss”,IF(D5<C5,”Loss”,IF(D5>C5,”Profit”)))

How do you create a profit and loss statement in Excel?

How to Create a Profit and Loss Statement in Excel

- Download, Open, and Save the Excel Template.

- Input Your Company and Statement Dates.

- Calculate Gross Profit.

- Input Sales Revenue to Calculate Gross Revenue.

- Input the Cost of Goods Sold (COGS)

- Calculate the Net Income.

- Input Your Business Expenses.

How do you show profit and loss on Excel chart?

Right-click on any of the bars. Click on ‘Change Series Chart Type’. In the Change Chart Type dialog box, make sure Combo category is selected (which it should be by default). Click on the drop-down for Profit Margin.

Does Google sheets have a profit and loss template?

Templates in Google Docs/Google Sheets often need a little bit of guidance to use, so we’ve outlined the most vital steps below: Open the Template. Click on “File” -> “Make a copy” -> This will generate a copy to your own Google Drive. Once you’re in, connect your Profit and Loss report to Google Sheets with LiveFlow.

How do you calculate small business profit?

- The operating profit formula is:

- Gross profit = sales – direct cost of sales.

- Net profit = sales – (direct cost of sales + operating expenses)

- Gross profit margin = (gross profit/ sales) x 100.

- Net profit margin = (net profit/ sales) x 100.

- Read more about how to increase profit.

What is a good profit margin for selling products?

As a general rule of thumb, a 10% net profit margin is deemed average, while a 20% margin is deemed high and 5% low. If you want to compare your company’s performance based on profit and merchandise margins, check out the average profit margin for your industry.

How much do I markup my product?

Charging a 50% markup on your products or services is a safe bet, as it ensures that you are earning enough to cover the costs of production plus are earning a profit on top of that. Too small of margins and you may barely be earning money on top of the costs of making the product.

What is the formula for pricing products?

Retail Price = Cost of Goods + Markup. Markup = Retail Price – Cost of Goods. Cost of Goods = Retail Price – Markup.