How do I create an expense and income spreadsheet in Excel?

How to Create a Formula for Income & Expenses in Excel

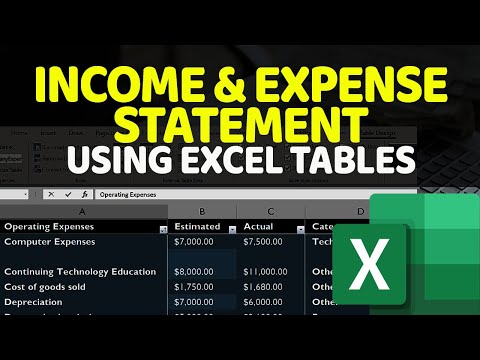

- Open your income and expenses Excel worksheet.

- Select an empty cell beneath the last item in your “income” column.

- Type “Total Income” in this cell, then press the “Enter” key.

- Select the cell directly beneath the “Total Income” label.

How do you keep track of trucking expenses?

Many trucking business owners keep track of their expenses through a spreadsheet on Excel. Others prefer using pen and paper to input data. TMS, otherwise known as Trucking Management Software, however, is the most efficient way of keeping track of expenses and other data.

How do I manage income and expenses in Excel?

How much income does a truck generate?

Average truck driver pay per mile is between 28 and 40 cents per mile. Most drivers complete between 2,000 and 3,000 miles per week. That translates into average weekly pay ranging from $560 to $1,200. If you drove all 52 weeks in a year at those rates, you would earn between $29,120 and $62,400.

How do I turn an Excel spreadsheet into a business expense?

In short, the steps to create an expense sheet are:

- Choose a template or expense-tracking software.

- Edit the columns and categories (such as rent or mileage) as needed.

- Add itemized expenses with costs.

- Add up the total.

- Attach or save your corresponding receipts.

- Print or email the report.

How do I set up an Excel spreadsheet for finances?

How to Create a Budget Spreadsheet in Excel

- Identify Your Financial Goals. …

- Determine the Period Your Budget Will Cover. …

- Calculate Your Total Income. …

- Begin Creating Your Excel Budget. …

- Enter All Cash, Debit and Check Transactions into the Budget Spreadsheet. …

- Enter All Credit Transactions.