How do you account for merchandise inventory?

To arrive at the value of merchandise inventory, multiply the amount of unsold inventory with the cost of each unit. This merchandise inventory value, which is usually considered the same as the ending inventory, is then entered into the balance sheet.

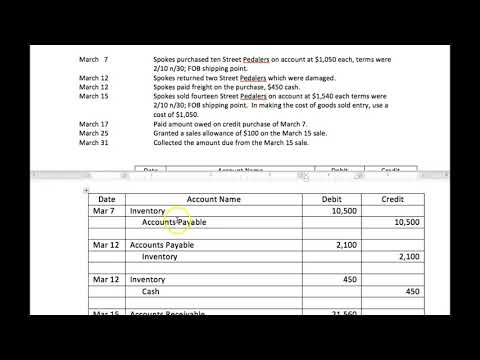

How do you do merchandising journal entries?

Is merchandise inventory a debit or credit?

Merchandise inventory is the account on a balance sheet that reflects the total amount paid for products that are yet to be sold. As a current asset, merchandise inventory is basically a holding account for inventory that’s waiting to be sold. It has a normal debit balance, so debit increases and credit decreases.

Is merchandise inventory an accounts receivable?

Merchandise inventory and accounts receivable are both considered “current assets,” meaning that a company can generally expect to convert them into cash within the next year. But accounts receivable are considered the more liquid of the two.

Where do you put merchandise inventory?

Merchandise inventory may be located in three areas: in transit from suppliers (under FOB shipping point terms), in the company’s storage facilities, or on consignment in locations owned by third parties.

How do you adjust merchandise inventory?

Adjustments for Merchandise Inventory

- Debit the beginning inventory balance to Income Summary, and credit the Merchandise Inventory account.

- Debit the ending inventory balance to Merchandise Inventory, and credit the Income Summary account.

How do you record merchandise inventory end?

For merchandise inventory, record the amount of the ending inventory in the Balance Sheet Debit column. For unearned revenue, record the unearned revenue account in the Balance Sheet Credit column and the revenue account in the Income Statement Credit column.

How do you record merchandise transactions?

How do you record inventory sales?

You credit the finished goods inventory, and debit cost of goods sold. This action transfers the goods from inventory to expenses. When you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale.