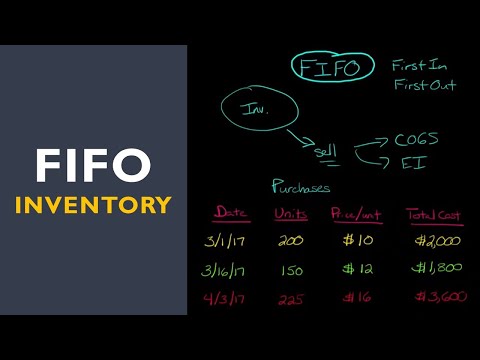

How do you calculate FIFO ending inventory?

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

What is ending inventory using FIFO?

FIFO is an accounting method that assumes the inventory you purchased most recently was sold first. Using this method, the cost of your most recent inventory purchases are added to your COGS before your earlier purchases, which are added to your ending inventory.

What is the formula for ending inventory?

Use this figure to calculate ending inventory using the following formula: Beginning inventory + COGS = total cost of goods available for sale. Gross profit x sales = estimated cost of goods sold. Total cost of goods available for sale – cost of goods sold = ending inventory.

How do you calculate ending inventory using FIFO in Excel?

Inventory Formula – Example #2

- FIFO Method. Ending Inventory is calculated using the formula given below. Ending Inventory = Total Inventory – Total Sold Inventory. …

- LIFO Method. Ending Inventory is calculated using the formula given below. Ending Inventory = Total Inventory – Total Sold Inventory. …

- Weighted Average Cost Method.

How do you calculate cost of goods sold and ending inventory using FIFO?

How do you find beginning and ending inventory?

The beginning inventory formula looks like this:

- (Cost of Goods Sold + Ending Inventory) – Inventory Purchases during the period = Beginning Inventory. …

- Amount of Goods Sold x Unit Price = Cost of Goods Sold. …

- Amount of Goods in Stock x Unit Price = Ending Inventory.