How do you calculate negative margin?

You can calculate a negative profit margin using the same equation as the profit margin:

- Profit margin = (net income / total revenue) x 100.

- Net income = total revenue – total expenses.

- Total revenue = quantity sold x price.

- Linda’s Lampshades sells decorative organic cotton lampshades. …

- Its profit margin was:

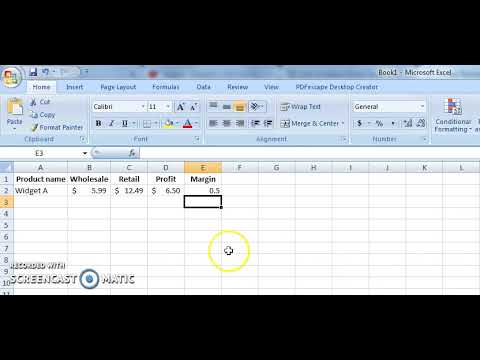

How do you calculate negative profit margin in Excel?

Can you have negative margin?

Gross profit margin can turn negative when the costs of production exceed total sales. A negative margin can be an indication of a company’s inability to control costs.

How do you show negative percentage change in Excel?

One common way to calculate percentage change with negative numbers it to make the denominator in the formula positive. The ABS function is used in Excel to change the sign of the number to positive, or its absolute value.

What if contribution margin is negative?

If a product’s contribution margin is negative, the company is losing money with each unit it produces, and it should either drop the product or increase prices.

What does it mean to have a negative profit margin?

An overall negative profit margin implies that the business is earning less than its expenditure.

How do you calculate net margin in Excel?

To put this into an Excel spreadsheet, insert the starting values into the spreadsheet. For example, put the net sales amount into cell A1 and the cost of goods sold into cell B1. Then, using cell C1, you can calculate the gross profit margin by typing the following into the cell: =(A1-B1)/A1.

How do I calculate margin?

To calculate your margin, use this formula:

- Find your gross profit. Again, to do this you minus your cost from your price.

- Divide your gross profit by your price. You’ll then have your margin. Again, to turn it into a percentage, simply multiply it by 100 and that’s your margin %.

Can you have negative revenue?

If you didn’t make any sales, revenue would simply be zero. In such a situation, any expenses incurred would result in loss. In some rare cases, companies do report negative revenue. A negative value may be related to a change in accounting principles..

What do you call negative gross margin?

According to Cheng Lee, et al., in “Statistics for Business and Financial Economics,” when your business generates a net loss, you get a negative profit margin, which business owners typically refer to just that way. A negative profit margin expresses the loss, rather than net income, as a percentage of sales.

Can a percent change be negative?

Positive values indicate a percentage increase while negative values indicate a percentage decrease.

How do I calculate the difference between two negative numbers in Excel?

The percentage difference between the two numbers in Excel

- The difference between numbers A2 and B2 (A2-B2) can be negative. So, we have used the ABS() function (ABS(A2-B2)) to make the number absolute.

- Then we have multiplied the absolute value by 2 and then divided the value by (A2+B2)

What is a negative contribution?

Definition of Negative Contribution Margin A negative contribution margin ratio indicates that a company’s variable costs and expenses exceed its sales. In other words, if the company increases its sales with the same sales mix, it will experience larger losses.

What is negative margin CSS?

It is possible to give margins a negative value. This allows you to draw the element closer to its top or left neighbour, or draw its right and bottom neighbour closer to it. Also, there is an exception we’ll get to in a minute.

How do you find the breakeven point in negative contribution margin?

How to calculate break-even point

- Sales price per unit.

- Fixed costs.

- Variable costs per unit.

- Revenue.

- Contribution margin.

- Contribution margin ratio.

- Break-even point in units = Fixed costs ÷ Contribution margin per unit.

- Break-even point in dollars = Sales price per unit * Break-even point in units.

How do you fix a negative profit?

If you have a negative profit percentage chances are, you are spending more money on your operational expenses than you should be. The way to fix a negative profit percentage is to start cutting expenses.

What happens if your net profit is negative?

A negative net profit margin results from the “net” part of the equation — the balance between revenue and expenses is off. It means that the money you make from selling your products or services is not enough to cover the cost of making or selling those products or services.