How do you create a cost sheet?

How to Create Cost & Expense Sheets in Excel

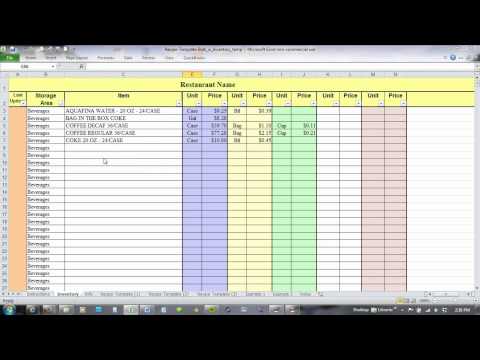

- Open a blank Microsoft Excel spreadsheet. …

- Write down the necessary categories for your spreadsheet. …

- Type the date in the first column on the Excel spreadsheet.

- Type a column for the “Payee” of the costs and expenses next to the “Date” column.

What is a cost template?

A cost template determines: The project categories for forecast and actual transactions to be included in a percentage of the project completion calculation. The percent-complete value is then used to calculate how much revenue is recognized.

Where can I get free Excel templates?

Go to Office.com. Click Templates at the top of the page. On the Templates page, click Excel. Tip: To see more templates, under BROWSE BY CATEGORY, click the category (like Calendars) that you want to see.

How do you create a cost model in Excel?

What is cost sheet with example?

A cost sheet is a statement that shows the various components of total cost for a product and shows previous data for comparison. You can deduce the ideal selling price of a product based on the cost sheet. A cost sheet document can be prepared either by using historical cost or by referring to estimated costs.

How do you calculate product cost?

Add It Up

- Step 1: Find your base production cost. Material Costs + Labor Costs + Shipping/Postage + Marketplace Fees + Misc. …

- Step 2: Determine your profit margin. Base Production Cost x Markup = Profit Margin. …

- Step 3: Establish your product price. Profit Margin + Base Production Cost = Product Price.

What is the format of cost sheet?

Method of Preparation of Cost Sheet

| Step I | Prime Cost = Direct Material Consumed + Direct Labour + Direct Expenses Direct Material= Material Purchased + Opening stock of raw material-Closing stock of raw material. |

|---|---|

| Step IV | Total Cost = Cost of Production + Selling and Distribution Overheads |

| Profit | Sales – Total Cost |

How do you calculate product cost in Excel?

Product Cost = Direct Material Cost + Direct Labor Cost + Manufacturing Overhead Cost

- Product Cost = $1,000,000 + $350,000 + $38,000.

- Product Cost = $1,388,000.

What are the costing methods?

Methods of Costing

- 1] Job Costing. Many firms and businesses work on a job work basis. …

- Browse more Topics under Fundamentals Of Cost Accounting. Origin and Evolution of Cost Accounting. …

- 2] Batch Coting. …

- 3] Process Costing. …

- 4] Operating Costing. …

- 5] Contract Costing.

How do I create a daily expense sheet in Excel?

Using the Expense Report Template in Excel:

- For each expense, enter the date and description.

- Use the dropdown menus to select payment type and category for each expense.

- For each expense, enter the total cost.

- Attach all necessary receipts to the document.

- Submit for review and approval!

Where do I find Excel templates in Excel?

Open Microsoft Excel. On the right side of the Home tab, click More templates. Scroll through the displayed list of templates to find the one that suits your needs. If you don’t find one you like, you can use the Search for online templates text field to see if there is a template online for what you need.

Where can you find thousands of templates for Excel?

You can search for thousands of templates at templates.office.com.

What is the formula for calculating cost of sales?

To calculate the cost of sales, add your beginning inventory to the purchases made during the period and subtract that from your ending inventory. To calculate the total values of sales, multiply the average price per product or service sold by the number of products or services sold.

Which items are not included in cost sheet?

Items Excluded From Cost Accounts

- Items of Appropriation of Profit. Income tax paid and legal expenses incurred in connection with the assessment of income tax. Transfer to reserves. …

- Items of Pure Finance. Interest and dividends received on investments. Rent received. …

- Abnormal Items. Cost of abnormal idle time.

Is income tax included in cost sheet?

It includes rent, rates, taxes, insurance, lighting, depreciation, power, fuel, advertisement and repairs and maintenance. On the basis of relation to cost centre, costs are classified as direct costs and indirect costs.

How do you calculate work cost from cost sheet?

(1) Prime Cost is the aggregate of Direct materials, Direct Labour and Direct Expenses. (2) Works Cost is the aggregate of prime cost and works overhead. It consists of the total of all items of cost incurred in the manufacturing of a product. Works Cost = Prime Cost + Works Overhead.