How do you find ending inventory in LIFO?

According to the LIFO method, the last units purchased are sold first, so the value used for the ending inventory formula is based on the cost of the oldest units. This means that the ending inventory for this period for Invest Media would be 2,250 x 10 = $22,500.

How do you calculate the ending inventory?

The basic formula for calculating ending inventory is: Beginning inventory + net purchases – COGS = ending inventory. Your beginning inventory is the last period’s ending inventory. The net purchases are the items you’ve bought and added to your inventory count.

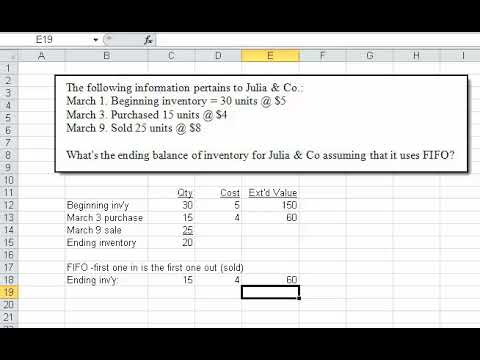

How do you calculate ending inventory using FIFO?

Is ending inventory the same for FIFO and LIFO?

Using FIFO for inventory valuation Using FIFO generates these results: Cost of goods sold: Selling the older (cheaper) units first generates a lower cost of goods sold than LIFO. Ending inventory: The newer, more expensive units remain in ending inventory, which is a higher balance than the LIFO method.

What is FIFO and LIFO example?

First-in, first-out (FIFO) assumes the oldest inventory will be the first sold. It is the most common inventory accounting method. Last-in, first-out (LIFO) assumes the last inventory added will be the first sold. Both methods are allowed under GAAP in the United States. LIFO is not allowed for international companies.

How do you calculate ending inventory using lower of cost or market?

Here are the steps to valuing inventory at the lower of cost or market:

- First, determine the historical purchase cost of inventory.

- Second, determine the replacement cost of inventory. …

- Compare replacement cost to net realizable value and net realizable value minus a normal profit margin.

What is ending inventory in accounting?

Ending inventory is the value of goods still available for sale and held by a company at the end of an accounting period. The dollar amount of ending inventory can be calculated using multiple valuation methods.

How do you find ending inventory using gross profit?

How to calculate ending inventory using the gross profit method

- Cost of good available = Cost of beginning inventory + Cost of all purchases.

- Cost of good sold = Sales ∗ Gross profit percentage.

- Ending inventory using gross profit = Cost of goods available − Cost of goods.