How do you prepare a schedule of cost of goods manufactured?

The COGM schedule was created to simplify this process….The Cost of Good Manufactured Schedule.

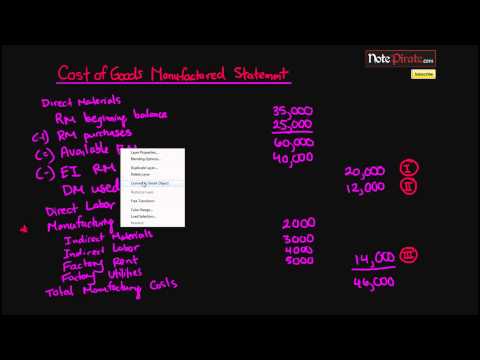

| Direct Materials | (Beginning Raw Materials + Purchases – Ending Raw Materials) |

|---|---|

| = Total Manufacturing Cost | (Direct Materials + Direct Labor + Manufacturing) |

| + Beginning Work in Process (WIP) Inventory | |

| – Ending WIP Inventory |

How do you prepare a statement of cost of goods manufactured?

What is shown on the schedule of cost of goods manufactured?

The cost of goods manufactured schedule reports the total manufacturing costs for the period that were added to work‐in‐process, and adjusts these costs for the change in the work‐in‐process inventory account to calculate the cost of goods manufactured.

How do you schedule a cost of goods sold?

The basic formula for cost of goods sold is:

- Beginning Inventory (at the beginning of the year)

- Plus Purchases and Other Costs.

- Minus Ending Inventory (at the end of the year)

- Equals Cost of Goods Sold. 4

How do you calculate cost of goods manufactured per unit?

To determine per unit cost of a product, you first have to calculate the total manufacturing cost of all the items manufactured during the given period. Then, divide the estimated value by the number of items. The end figure you obtain is one unit’s manufacturing cost.

How do you calculate manufacturing costs?

To calculate total manufacturing cost you add together three different cost categories: the costs of direct materials, direct labour and manufacturing overheads. Expressed as a formula, that’s: Total manufacturing cost = Direct materials + Direct labour + Manufacturing overheads. That’s the simple version.

What is included in cost of goods manufactured?

The Cost of Goods Manufactured is the total manufacturing costs of goods that are finished during a certain accounting period. These costs include direct materials, direct labor, and manufacturing overhead of the products that are transferred from the manufacturing department to the finished goods inventory.

How do you calculate cost of goods manufactured in Excel?

Cost of Goods Sold = Beginning Inventory + Purchases during the year – Ending Inventory

- Cost of Goods Sold = Beginning Inventory + Purchases during the year – Ending Inventory.

- Cost of Goods Sold = $20000 + $5000 – $15000.

- Cost of Goods Sold = $10000.

How do you solve an incomplete cost of goods manufactured schedule?

How do you find cost of goods manufactured and cost of goods sold?

The calculation of the cost of goods sold for a manufacturing company is:

- Beginning Inventory of Finished Goods.

- Add: Cost of Goods Manufactured.

- Equals: Finished Goods Available for Sale.

- Subtract: Ending Inventory of Finished Goods.

- Equals: Cost of Goods Sold.

How do you compute the total manufacturing costs added to production within a schedule of cost of goods manufactured?

For this situation, the calculation of total manufacturing cost is as follows: Direct materials. Add the total cost of materials purchases in the period to the cost of beginning inventory, and subtract the cost of ending inventory. The result is the cost of direct materials incurred during the period.

What is cost of goods sold Example?

The cost of goods made or bought is adjusted according to change in inventory. For example, if 500 units are made or bought but inventory rises by 50 units, then the cost of 450 units is cost of goods sold. If inventory decreases by 50 units, the cost of 550 units is cost of goods sold.

How do you calculate manufacturing units?

To compute the number of units manufactured, start with the number of units of work-in-process in beginning inventory (Beginning). Add the number of units of direct materials put into production (Inputs) and then subtract the number of units of work-in-process in ending inventory (Outputs).

What are the three basic types of manufacturing costs?

The three general categories of costs included in manufacturing processes are direct materials, direct labor, and overhead.

What is the total manufacturing costs?

Total manufacturing cost is the amount of money a company spends on its manufacturing operations, or essentially how much it costs in total to produce the goods that will be sold on to customers. As the name suggests, it takes absolutely all spend into account.

What is manufacturing cost accounting?

Manufacturing cost is the sum of costs of all resources consumed in the process of making a product. The manufacturing cost is classified into three categories: direct materials cost, direct labor cost and manufacturing overhead. It is a factor in total delivery cost.