How do you record sold merchandise on credit?

We can make the journal entry for sold merchandise on account by debiting the sale amount into the accounts receivable and crediting the same amount into the sales revenue….Perpetual inventory system.

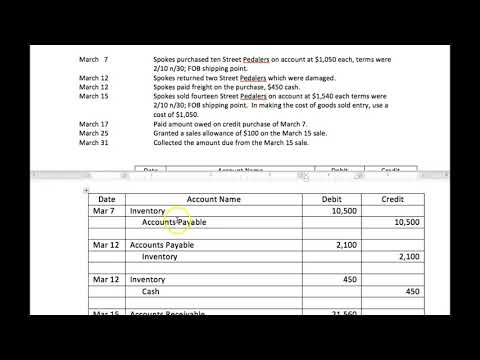

| Account | Debit | Credit |

|---|---|---|

| Cost of goods sold | $$$ | |

| Merchandise inventory | $$$ |

What is the journal entry for sold merchandise?

When merchandise are sold on account, the two accounts involved in the transaction are the accounts receivable account and sales account. The accounts receivable account is debited and the sales account is credited.

What is sold merchandise on credit?

What are Credit Sales? Credit sales refer to a sale in which the amount owed will be paid at a later date. In other words, credit sales are purchases made by customers who do not render payment in full, in cash, at the time of purchase.

How do you account for merchandise inventory?

To arrive at the value of merchandise inventory, multiply the amount of unsold inventory with the cost of each unit. This merchandise inventory value, which is usually considered the same as the ending inventory, is then entered into the balance sheet.

How do you calculate credit sales?

Calculate credit sales from total sales To start calculating credit sales, determine the cash received. Once you have these figures, determine credit sales by reducing total sales by the amount of total cash received. The credit sales equals total sales minus cash received.

Is merchandise sales a debit or credit?

If a customer returns merchandise before remitting payment, the company would debit Sales Returns and Allowances and credit Accounts Receivable or Cash. The company may return the merchandise to their inventory by debiting Merchandise Inventory and crediting COGS.

How do you do merchandising journal entries?