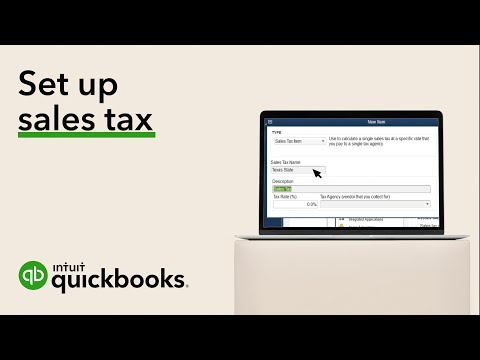

How do you set up sales tax in QuickBooks?

More videos on YouTube

- Go to the Edit menu, then select Preferences.

- On the Preferences window, select Sales Tax then go to the Company Preferences tab.

- Select Yes to turn on sales tax.

- Set up the sales tax items or sales tax groups for each county, district, city, etc. …

- Assign sales tax codes.

How do I categorize sales tax in QuickBooks?

Create a Sales Tax item.

- Select the Gear icon at the top, then Products and Services.

- In the Products and Services page, select New.

- Select Non-Inventory or Service for Item Type.

- Enter Sales Tax in the Name and Description fields.

How do you set up sales tax in QuickBooks online?

Add a tax rate and agency

- Go to Taxes, then select Sales tax (Take me there).

- Under the Related Tasks list on the right, select Add/edit tax rates and agencies.

- Select New and choose either a single or a combined tax rate.

- Enter a name for the tax, the agency you pay, and the percentage for the rate. …

- Select Save.

What determines how much the cost of goods sold account increases when you sell an item?

9: What happens to the Cost of Goods Sold account when you sell an item? It increases by the amount you paid for it.

How do I calculate sales tax in QuickBooks desktop?

How do you record sales tax?

To record received sales tax from customers, debit your Cash account, and credit your Sales Revenue and Sales Tax Payable accounts. When you remit the sales tax to the government, you can reverse your initial journal entry. To do this, debit your Sales Tax Payable account and credit your Cash account.

What is a sales tax group in QuickBooks?

Does QuickBooks automatically calculate sales tax?

QuickBooks will automatically calculate sales tax for you while also tracking other relevant financial information. Automating your calculations ensures you collect and pay the proper and total amount of sales tax.

What is the difference between cost of goods sold and an expense in QuickBooks?

Expenses are the indirect costs of the business, whereas COGS are the direct expenses related to what you sell.

How do you adjust cost of goods sold?

The cost of goods made or bought is adjusted according to change in inventory. For example, if 500 units are made or bought but inventory rises by 50 units, then the cost of 450 units is cost of goods sold. If inventory decreases by 50 units, the cost of 550 units is cost of goods sold.

What is the difference between inventory and costs of goods sold?

The Difference Between Inventory and Cost of Goods Sold Inventory includes all of the raw materials, work-in-progress, and finished goods that a company has on hand. COGS only includes the direct costs associated with the production of the goods that were sold.

How do I record sales in Quickbooks?

You’ll use this template every time you need to record total daily sales.

- Select the Gear icon on the Toolbar.

- Under List, choose Recurring Transactions.

- Select New at the top right.

- From the Transaction Type dropdown, choose Sales Receipt.

- Name your template “Daily Sales” and make sure the Type is Unscheduled.