Is cost of goods manufactured on the income statement?

If you’re wondering where you can find the cost of good manufactured, take a look at the cost of goods sold section on the income statement. COGM is a key component of computing the cost of goods sold (COGS).

Why is cost of goods manufactured on the income statement?

The cost of goods manufactured schedule is used to calculate the cost of producing products for a period of time. The cost of goods manufactured amount is transferred to the finished goods inventory account during the period and is used in calculating cost of goods sold on the income statement.

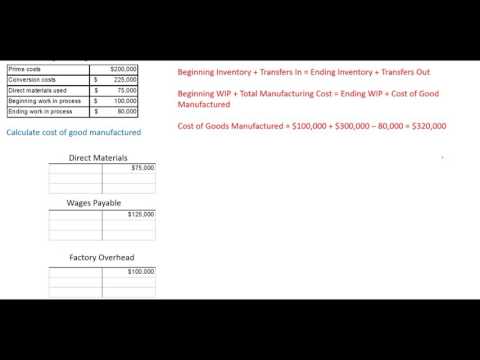

What is a cost of goods manufactured statement?

Cost of Goods Manufactured (COGM) is a term used in managerial accounting that refers to a schedule or statement that shows the total production costs for a company during a specific period of time.

How does a manufacturing company report cost of goods manufactured?

The formula and format for presenting the cost of goods manufactured is: The cost of the direct materials used. PLUS the cost of the direct labor used. PLUS the cost of manufacturing overhead assigned.

What is the income statement of manufacturing?

The income statement of a manufacturing company is one of the most important financial statements of the company. This statement reveals the company’s revenues, expenses, and net profit or loss records for an accounting period.

How do you prepare a manufacturing income statement?

Three schedules are necessary to prepare an income statement for a manufacturing company, in the following order: Schedule of raw materials placed in production, which shows cost of direct materials added to work-in-process inventory and cost of indirect materials added to manufacturing overhead.

What is the difference between total manufacturing costs and cost of goods manufactured?

What is the difference between cost of goods manufactured and cost of goods sold?

Cost of goods manufactured are the production costs incurred on finished goods produced in a specific accounting period. Cost of goods sold are the production costs incurred on goods actually sold in a specific accounting period.

What is on an income statement example?

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner.

How do you calculate cost of goods sold on an income statement?

One relatively simple way to determine the cost of goods sold is to compare inventory at the start and end of a given period using the formula: COGS = Beginning Inventory + Additional Inventory – Ending Inventory.

How do you calculate the manufacturing cost of a product?

In terms of the formula needed to calculate total manufacturing cost, it’s usually expressed in the following way: Total manufacturing cost = Direct materials + Direct labour + Manufacturing overhead.

Is cost of goods manufactured the same as cost of goods available for sale?

The cost of goods manufactured is not the same as the cost of goods sold. Goods manufactured may remain in stock for many months, especially if a company experiences seasonal sales. Conversely, goods sold are those sold to third parties during the accounting period.

Which income statement is most appropriate for a manufacturing business?

A manufacturing company must use a proper income statement format to appreciate gross profit and net income reports properly. The same design also helps to determine the cost of goods sold. Generally, this type of statement contains a wealth of information on the cost of goods sold.

How does the income statement of a manufacturing company differ from the income statement of a merchandising company?

Unlike merchandising firms, manufacturing firms must calculate their cost of goods sold based on how much they manufacture and how much it costs them to manufacture those goods. This requires manufacturing firms to prepare an additional statement before they can prepare their income statement.

What are the 4 basic components of income statement of a manufacturing business?

Understanding the Income Statement The income statement focuses on four key items—revenue, expenses, gains, and losses.

How manufacturing cost and non manufacturing cost affects the company financial statements?

Financial accounting treatment Manufacturing costs are accounted for as cost of goods sold in the trading account and impact gross profit of the entity. Non-manufacturing costs are accounted for in the general profit and loss account and impact the net profit of the entity.

What is a manufacturing statement?

Definition: A manufacturing statement, also called the schedule of cost of goods manufactured or the schedule of manufacturing activities, is a summary of all of the manufacturing activities and costs.