What accounts are used in a perpetual inventory system?

Recording Purchases: In a perpetual system, you record purchases in the raw materials inventory account or the merchandise account. In a periodic system, you log purchases into the purchases asset account, without adding any unit-count information.

How do you account for perpetual inventory?

What is the journal entry for perpetual inventory system?

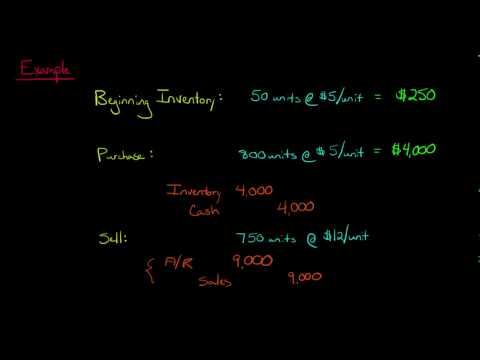

Journal Entries for Merchandise Purchaser (Perpetual Method) As inventory is purchased, the Merchandise account is debited. As inventory is sold, the Merchandise Inventory account is credited, and Cost of Goods Sold is debited for the cost of the inventory sold.

What is the perpetual inventory system example?

The most common perpetual inventory system example is the usage of wireless barcode scanners in a grocery store. It records all scanned transactions on the system immediately as they occur. This way, firms can easily compute the current and required stockpile.

What are the journal entries for a periodic inventory system?

Under the periodic inventory system, when company makes sales, they only record the revenue and accounts receivable/cash. The journal entry is debiting accounts receivable or cash and credit sales revenue. The transaction will increase the sale on income statement.

How do you record cost of goods sold in a perpetual inventory system?

The cost of goods sold is calculated by adding the beginning inventory and purchases to obtain the cost of goods available for sale and then deducting the ending inventory.

How do you record inventory purchases?

Inventory purchases are recorded on the operating account with an Inventory object code, and sales are recorded on the operating account with the appropriate sales object code. A cost-of-goods-sold transaction is used to transfer the cost of goods sold to the operating account.

What is another name for perpetual inventory system?

In business and accounting/accountancy, perpetual inventory or continuous inventory describes systems of inventory where information on inventory quantity and availability is updated on a continuous basis as a function of doing business.

What is the difference between perpetual and periodic inventory system?

The periodic inventory system uses an occasional physical count to measure the level of inventory and the cost of goods sold. The perpetual system keeps track of inventory balances continuously, with updates made automatically whenever a product is received or sold.

How do you record freight in a perpetual system?

As mentioned, under the perpetual inventory system, the company needs to record the freight-in cost as a part of the inventory cost. Likewise, the company needs to make the freight-in journal entry in this case, by debiting the freight-in cost into the inventory account and crediting the cash account.

How does the purchase of inventory on account under the perpetual inventory method affect the financial statements?

How does the purchase of inventory on account under the perpetual inventory method affect the financial statements? Total assets and total liabilities both increase. The term “FOB Shipping Point” means: The buyer pays the shipping cost.

Where does inventory go on a balance sheet?

Inventory is an asset and its ending balance is reported in the current asset section of a company’s balance sheet.

Is inventory an asset or liability?

Inventory is the raw materials used to produce goods as well as the goods that are available for sale. It is classified as a current asset on a company’s balance sheet.

What account type is inventory?

Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a company has accumulated.