What is perpetual journal entries?

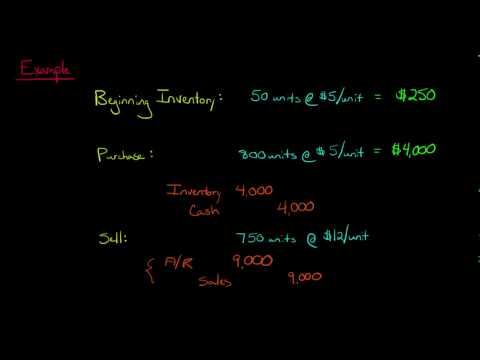

In a perpetual system, two journal entries are required when a business makes a sale: one to record the sale and one to record the cost of the sale.

How do you Journalize perpetual inventory entries?

Perpetual Inventory System Journal Entries

- Inventory Purchase: Under perpetual inventory system, a purchase is recorded by debiting inventory account and crediting accounts payable assuming that the purchase is on credit. …

- Purchase Discount: …

- Purchase Return: …

- Inventory Sale: …

- Sales Return:

What is an example of perpetual inventory?

The most common perpetual inventory system example is the usage of wireless barcode scanners in a grocery store. It records all scanned transactions on the system immediately as they occur. This way, firms can easily compute the current and required stockpile.

What accounts are used in a perpetual inventory system?

Perpetual inventory system provides a running balance of cost of goods available for sale and cost of goods sold. Under this system, no purchases account is maintained because inventory account is directly debited with each purchase of merchandise.

How do you do perpetual?

What is difference between perpetual and periodic inventory system?

A perpetual inventory system inventory updates purchase and sales records constantly, particularly impacting Merchandise Inventory and Cost of Goods Sold. A periodic inventory system only records updates to inventory and costs of sales at scheduled times throughout the year, not constantly.

What is perpetual inventory method?

Perpetual inventory is a continuous accounting practice that records inventory changes in real-time, without the need for physical inventory, so the book inventory accurately shows the real stock. Warehouses register perpetual inventory using input devices such as point of sale (POS) systems and scanners.

Is freight out periodic or perpetual?

Periodic inventory system Similar to the purchase account, the freight-in account is a temporary account that will be cleared at the end of the accounting period when the company makes the cost of goods calculation.

How do you solve a perpetual inventory system?

How does the perpetual inventory system work?

- Step 1: Point-of-sale system updates inventory levels. …

- Step 2: Cost of goods sold is updated automatically. …

- Step 3: Reorder points are adjusted frequently. …

- Step 4: Purchase orders are automatically generated. …

- Step 5: Received products are scanned into inventory.

What is another name for perpetual inventory system?

In business and accounting/accountancy, perpetual inventory or continuous inventory describes systems of inventory where information on inventory quantity and availability is updated on a continuous basis as a function of doing business.

What is the journal entry for inventory?

A journal entry for inventory is a record in your accounting ledger that helps you track your inventory transactions. Depending on the type of inventory and how much your business carries, there are different kinds of journal entries that may help you organize your financial expenses and earnings.

What are the journal entries for a periodic inventory system?

Under the periodic inventory system, when company makes sales, they only record the revenue and accounts receivable/cash. The journal entry is debiting accounts receivable or cash and credit sales revenue. The transaction will increase the sale on income statement.

What is perpetual example?

The definition of perpetual is something that goes on or lasts forever or an extremely long time. An example of perpetual is love between a mother and child. adjective.

What are the three most important advantage of the perpetual inventory system?

Some of the advantages of perpetual inventory control are: 1. Quick valuation of closing stock 2. Lesser investment in materials 3. Helpful in formulating proper purchase policies 4.