What is purchasing power parity formula?

Purchasing power parity refers to the exchange rate of two different currencies in equilibrium. The PPP formula is calculated by multiplying the cost of a particular product or service with the first currency by the price of the same goods or services in U.S. dollars.

What is purchasing power parity example?

This means that goods in each country will cost the same once the currencies have been exchanged. For example, if the price of a Coca Cola in the UK was 100p, and it was $1.50 in the US, then the GBP/USD exchange rate should be 1.50 (the US price divided by the UK’s) according to the PPP theory.

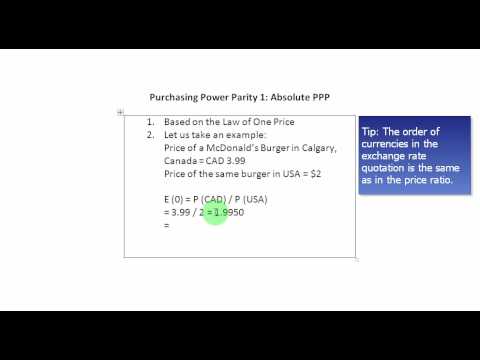

How do you calculate absolute purchasing power parity?

How do you calculate PPP in Excel?

S = P1 / P2

- Purchasing Power Parity = 5000 / 9000.

- Purchasing Power Parity = 0.556.

How is purchasing power calculated?

To calculate the purchasing power, collect the CPI information from the Bureau of Labor Statistics. In January 1975, the CPI was 38.8 and in January 2018, was 247.9. Divide the earlier year by the later year and multiply by 100 to derive the CPI change during that period: (38.8 / 247.9) x 100 = 15.7 percent.

What is purchasing power parity Byjus?

The purchasing power parity or PPP is an economic indicator that refers to the purchasing power of the currencies of various nations of the world against each other.

What does a PPP less than 1 mean?

Hence, numbers below 1 imply that if you exchange 1 dollar at the corresponding market exchange rate, the resulting amount of money in local currency will buy you more in that country than you could have bought with one dollar in the US in the same year.

What is purchasing power parity PDF?

Purchasing power parity (PPP) is a disarmingly simple theory that holds that. the nominal exchange rate between two currencies should be equal to the. ratio of aggregate price levels between the two countries, so that a unit of. currency of one country will have the same purchasing power in a foreign country.

How do you calculate interest parity?

Interest rate parity is a theory that helps resolve the balance between these two figures when investing….Interest rate parity formula

- ST(a/b) = The Spot Rate.

- St(a/b) = Expected Spot Rate at time T.

- Ft(a/b) = The Forward Rate.

- T = Time to Expiration Date.

- ia = Interest Rate of Country A.

- ib = Interest Rate of Country B.

How is PPP headcount calculated?

Enter the average number of hours each employee worked per week, divide by 40, and round to the nearest tenth (maximum, 1.0). Assign a 1.0 for employees who work 40 hours or more per week and 0.5 for employees who work fewer hours.

Is CPI same as purchasing power?

In general, the purchasing power of a currency used in a market is inversely proportional to the change in CPI, meaning if the CPI goes up, the purchasing power of the same money goes down.

What is purchasing power parity Mcq?

Solution(By Examveda Team) Purchasing-power parity (PPP) refers to the concept that the same goods should sell for the same price across countries after exchange rates are taken into account.

What is purchasing power parity Class 12?

Purchasing power parity refers to the ratio of purchasing power of the currencies of trading partners. It is the ratio of price levels in different nations. Thus, exchange rate between the two nations is equal to the ratio of the price levels in the two nations. Rate of exchange = P1/P2.

What is the PPP of India?

India – Gross domestic product per capita based on purchasing-power-parity in current prices. GDP per capita based on PPP of India slumped by 7.59 % from 6,992 international dollars in 2019 to 6,461 international dollars in 2020.