What is the accounts payable ledger?

Key Takeaways. An accounts payable subsidiary ledger is an accounting ledger that shows the transaction history and amounts owed to each supplier and vendor. An accounts payable (AP) is essentially an extension of credit from a supplier that gives a business (the buyer) time to pay for the supplies.

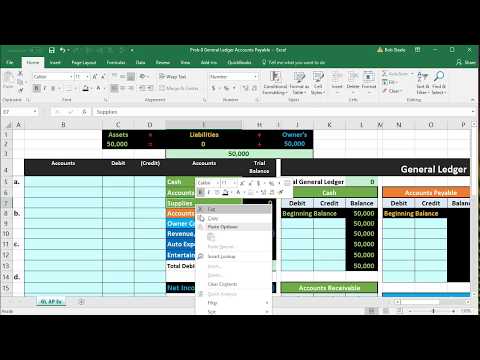

How do you prepare accounts payable ledger?

The following steps outline how to use the accounts payable ledger:

- List the date of the transaction. …

- Include the invoice number and the payment amount. …

- Enter the name of the vendor or creditor. …

- Give some brief details about the transaction. …

- Schedule due dates for future payments.

How do you post accounts payable in ledger?

What are examples of accounts payable?

Accounts payable examples include accrued expenses like logistics, licensing, leasing, raw material procurement, and job work. Accounts payable show the balance that has not yet been paid to the associated individual to complete the transaction.

How do you record accounts payable?

When recording an account payable, debit the asset or expense account to which a purchase relates and credit the accounts payable account. When an account payable is paid, debit accounts payable and credit cash.

How do you enter accounts payable?

Accounts payable is a liability account, so if you’re using double-entry accounting, any increase to this account would be posted as a credit, with a corresponding debit made to an expense account. When accounts payable items are paid, the accounts payable account is debited, with cash credited.