What is the format of trading account?

Solved Example For You

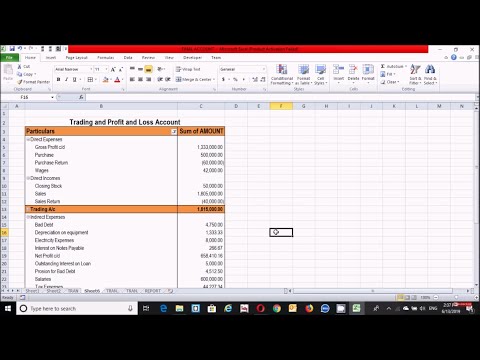

| Particulars | Amount | |

|---|---|---|

| Goods as sample 100 | (100) | 48300 |

| To carriage inward | 1,450 | |

| To wages | 400 | |

| To commission on purchases | 100 |

How do you prepare a trading account in accounting?

1. Trading Account

- Gross profit = Net sales – Cost of goods sold. Where.

- Net sales = Gross sales of the business minus sales returns, discounts and allowances. The trading account considers only the direct expenses and direct revenues while calculating gross profit. …

- In case of Gross Loss. …

- In case of Gross Profit.

What are the items in trading account?

The various elements of trading accounts, based on its contents, includes opening stock, details of purchase, gross profit, direct expenses, gross loss, closing stock, and sales revenue.

Which entry comes in trading account?

Closing Entries for Trading Account

| Trading Account | Debit |

|---|---|

| To Beginning Stock A/c | Credit |

| To Purchases A/c | Credit |

| To Direct Expenses A/c | Credit |

| (Being Opening Stock, Purchases and Direct Expenses are transferred to Trading A/c) |

Is trading account a ledger?

Answer. Explanation: yes, trading account is ledger.

What is the format of final accounts?

Final accounts can be calculated as follows: Make a list of trial balance items and adjustments. Record debit items on expense side of P and L account or assets side in balance sheet. Record credit items on the income side of trading P and L account or liabilities side of balance sheet.

How do I create a trading account in Excel?

What is trading and P&L account?

Trading Account. Profit & Loss Account. Meaning. Trading account is an account which indicates the result of trading activities, such as purchase and sale of products. Profit & loss account is an account, representing the actual profit earned or loss sustained by the business during the accounting period.

Why do you prepare trading account?

Trading account is the first step in the process of preparing final accounts. It helps in finding out the gross profit or gross loss during an accounting year, which is an important indicator of business efficiency.

Is debited to trading account?

Explanation: Debit balance of Trading Account implies gross loss incurred as a result of the trading activities of the business. If the amount of purchases and direct expenses exceeds the amount of sales and stock at the end, then the difference amount is termed as a gross loss.

What is the format of balance sheet?

Format of the balance sheet In account format, the balance sheet is divided into left and right sides like a T account. The assets are listed on the left hand side whereas both liabilities and owners’ equity are listed on the right hand side of the balance sheet.

Which expenses are recorded in trading account?

All the expenses related to goods sold, sales and other direct expenses are accounted in the trading account.

What are ledger books?

A ledger is a book containing accounts in which the classified and summarized information from the journals is posted as debits and credits. It is also called the second book of entry. The ledger contains the information that is required to prepare financial statements.

What is final account PDF?

Final Accounts are the accounts, which are prepared at the end of a fiscal year. It gives a precise idea of the financial position of the business/organization to the owners, management, or other interested parties.

What is a closing stock?

Closing stock is referred to as the amount of unsold goods that remain with the business on a given date. In other words, it can be said that these are inventory which are in business and are waiting to be sold.