What is the journal entry for creditors?

The company can make the payment to creditors journal entry by debiting the payables account and crediting the cash account.

What is the journal entry of debtors?

The journal entry is passed by making a debit entry in Account Receivable and corresponding credit entry in Sales Account….Bad Debts – Allowance Method.

| Particulars | Debit | Credit |

|---|---|---|

| Bad debts expenses A/c | 25000 | |

| To allowance for doubtful A/c | 25000 | |

| Being amount of doubtful debtors recorded |

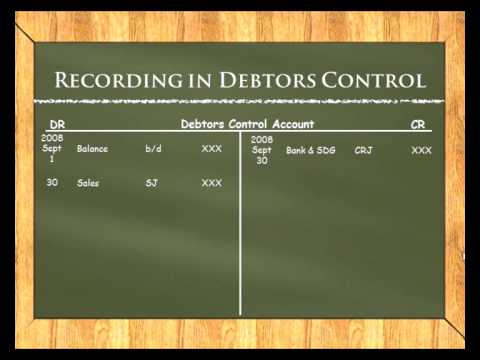

How do you record debtors and creditors?

Which journal is used to record payments from debtors?

A cash payment journal, also known as a cash disbursement journal, is used to record all cash payments (or disbursements) made by the business.

What is the double entry for debtors?

Double-entry bookkeeping means that every transaction entered both debits and credits different nominal codes. This means that your trial balance always balances. This article shows the debit and credit entries for each transaction type….Sales Credit Note.

| CR | Trade Debtors | (Gross) |

|---|---|---|

| DR | VAT | (VAT) |

What is difference between debtors and creditors?

In every credit relationship, there’s a debtor and a creditor: The debtor is the borrower and the creditor is the lender.

How do you record money from debtors?

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer’s accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

Do we credit or debit debtors?

Debtors have a debit balance, while creditors have a credit balance to the firm. Payments or the owed money are received from debtors while loans are made to creditors.