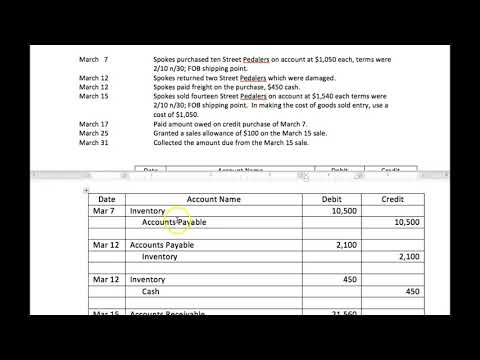

What is the journal entry of purchase merchandise on account?

What is the journal entry for purchase of merchandise on account? The journal entry for purchase of merchandise on account is the same as the journal entry for purchase of merchandise for cash, except that the accounts payable account is credited instead of the cash account.

How do you record merchandise journal entries?

Which journal is used to record merchandise purchased on account?

Special Journals

| Types and Purposes of Special Journals | ||

|---|---|---|

| Journal Name | Journal Purpose | Account(s) Debited |

| Sales Journal | Sales on credit | Accounts Receivable, Cost of Goods Sold |

| Purchases Journal | Purchases on credit | Inventory |

| Cash Disbursements Journal | Paying cash | Could be: Accounts Payable, or other accounts |

What does N 30 mean in accounting?

On an invoice, net 30 means payment is due thirty days after the invoice date. For example, if an invoice is dated January 1 and it says “net 30,” then the payment is due on or before January 30.

What does the sales discount 2/10 N 30 mean?

2/10 net 30 means that if the amount due is paid within 10 days, the customer will enjoy a 2% discount. Otherwise, the amount is due in full within 30 days.

How do you record merchandise transactions?

What is a merchandise transaction?

In a merchandising sales transaction, the seller sells a product and transfers the legal ownership (title) of the goods to the buyer. A business document called an invoice (a sales invoice for the seller and a purchase invoice for the buyer) becomes the basis for recording the sale.

Where can I record purchases on account?

Purchase is the cost of buying inventory during a period for the purpose of sale in the ordinary course of the business. It is therefore a kind of expense and is hence included in the income statement within the cost of goods sold….Cash Purchase.

| Debit | Purchases (Income Statement) |

| Credit | Cash |

What is the meaning of the expression 2/10 net 30 in a purchase order?

2/10 net 30, defined as the trade credit in which clients can opt to either receive a 2 percent discount for payment to a vendor within 10 days or pay the full amount (net) of their accounts payable in 30 days, is extremely common in business to business sales.

What does the term 3/10 n 30 mean?

3/10 net 30 means a 3% discount if a customer pays within 10 days. Otherwise, the total amount is due within 30 days of the invoice date.

What do the terms 1/10 net 30 mean?

A 1%/10 net 30 deal is when a 1% discount is offered for services or products as long as they are paid within 10 days of a 30-day payment agreement. The cost of credit is used as a percentage and occurs when the buyer does not take the reduced cost, thus paying the higher cost, reflecting the discount loss.

When goods are sold to a customer with credit terms of 2/15 N 30 the customer will?

15. When goods are sold to a customer with credit terms of 2/15, n/30, the customer will: A. receive a 15% discount if they pay within 2 days.

What does the sales discount 2/10 N 30 mean quizlet?

Explain what the credit terms of 2/10, n/30 mean. -The buyer can deduct 2% of the invoice amount if payment is made within 10 days of the invoice date. -The full payment is due within a 30 day credit limit. discount period. Time period in which a cash discount is available and the buyer can make a reduced payment.

How does the buyer benefits from the credit term of 2/10 N 30?

2/10 net 30 means that buyers are eligible to get a 2% discount on trade credit if the amount due is paid within 10 days. After those 10 days pass, the full invoice amount is due within 30 days without the 2% discount according to the terms for 2/0 net 30.

What is merchandise in accounting?

Merchandise is an inventory asset that a retailer, distributor or wholesaler purchases from a supplier to sell for profit.

What is purchases in merchandising?

Under the periodic system, a temporary expense account named merchandise purchases, or simply purchases, is used to record the purchase of goods intended for resale.

When merchandise is bought on credit the journal entry to be affected would be?

When a business purchases goods or services on credit, the business will then debit the purchases account, which will increase the business’s assets. The business will also credit the accounts payable account, which will increase the business’s liabilities.