What journal is purchased merchandise for cash?

Special Journals

| Types and Purposes of Special Journals | ||

|---|---|---|

| Journal Name | Journal Purpose | Account(s) Credited |

| Purchases Journal | Purchases on credit | Accounts Payable |

| Cash Disbursements Journal | Paying cash | Cash |

| Cash Receipts Journal | Receiving cash | Could be: Sales, Accounts Receivable, or other accounts |

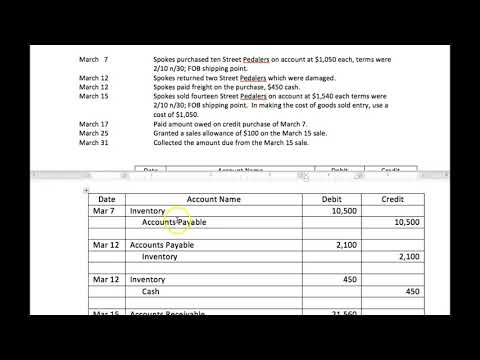

What is the journal entry for merchandise?

We can make the journal entry for sold merchandise on account by debiting the sale amount into the accounts receivable and crediting the same amount into the sales revenue. In this journal entry, the sold merchandise on account results in the increase of sales revenue and the increase of accounts receivable.

How do you record merchandise journal entries?

How do you record merchandise sold for cash?

In the case of a cash sale, the entry is:

- [debit] Cash. Cash is increased, since the customer pays in cash at the point of sale.

- [debit] Cost of goods sold. …

- [credit] Revenue. …

- [credit]. …

- [credit] Sales tax liability.

Where is a cash purchase of merchandise inventory recorded?

(The sales of merchandise inventory for cash is not recorded in the sales journal, but instead it is recorded in the cash receipts journal.)

What are merchandise purchases?

Definition: A merchandise purchases budget is a financial plan that reports the total estimates costs or units of merchandise inventory that are expected to be purchased by a retailer in an accounting period. In other words, this is the budget that managers use to plan inventory purchases for the upcoming periods.

How do you record merchandise?

The cost of merchandise sold was $30,000. Prepare a journal entry to record this transaction. When merchandise is sold, two journal entries are recorded. This is the journal entry to record sales revenue….Journal entry to record the sale of merchandise on account.

| Debit | Credit | |

|---|---|---|

| Accounts receivable | 50,000 | |

| Sales revenue | 50,000 |

How do you record merchandise transactions?

Is merchandise sales a debit or credit?

If a customer returns merchandise before remitting payment, the company would debit Sales Returns and Allowances and credit Accounts Receivable or Cash. The company may return the merchandise to their inventory by debiting Merchandise Inventory and crediting COGS.