What will be the journal entry for cash received from debtors?

Explanation: Since Ram is a Debtor, on receipt of cash from Ram, Ram’s A/c would be credited, as there is a decrease in Debtors which is an asset . According to the Rules of Debit and Credit, when an asset is decreased, the asset account is credited .

What is the journal entry for debtor?

Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. When you decide to write off an account, debit allowance for doubtful accounts and credit the corresponding receivables account.

What is the journal entry of cash received from?

2. Journal entry for cash received from the sale of goods

| Cash a/c | Debit | Debit the increase in asset |

|---|---|---|

| To Sales a/c | Credit | Credit the increase in revenue |

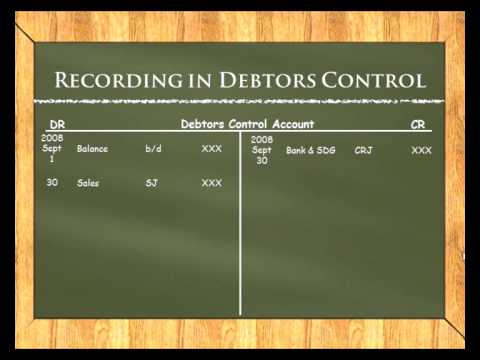

Where is cash received from debtors recorded?

When debtors pay their debt, the cash received is recorded in the CRJ.

Can we receive cash from Debtors?

Section 269ST of Income Tax Act Section 269ST of the Income Tax Act provides that no person can receive an amount of INR 2 Lakhs or more in cash: In aggregate from a person in a day; In respect of a single transaction; or. In respect of transactions relating to one event or occasion from a person.

What is the double entry for Debtors?

Double-entry bookkeeping means that every transaction entered both debits and credits different nominal codes. This means that your trial balance always balances. This article shows the debit and credit entries for each transaction type….Sales Credit Note.

| CR | Trade Debtors | (Gross) |

|---|---|---|

| DR | VAT | (VAT) |

How do you record a receivable?

Account receivable is the amount the company owes from the customer for selling its goods or services. The journal entry to record such credit sales of goods and services is passed by debiting the accounts receivable account with the corresponding credit to the Sales account.

How do you record debtors and creditors?