Which journal is used to record merchandise purchased on account?

Special Journals

| Types and Purposes of Special Journals | ||

|---|---|---|

| Journal Name | Journal Purpose | Account(s) Debited |

| Sales Journal | Sales on credit | Accounts Receivable, Cost of Goods Sold |

| Purchases Journal | Purchases on credit | Inventory |

| Cash Disbursements Journal | Paying cash | Could be: Accounts Payable, or other accounts |

What is bought merchandise in accounting?

Within accounting, merchandise is considered a current asset because it’s usually expected to be liquidated (sold, turned into cash) within a year. When purchased, merchandise should be debited to the inventory account and credited to cash or accounts payable, depending on how the merchandise was paid for.

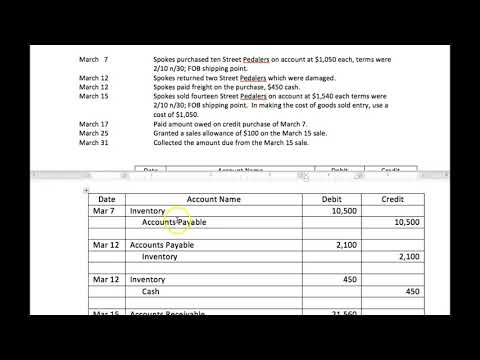

How do you record merchandise journal entries?

What is the journal entry for merchandise inventory?

When companies sell merchandise inventory, the transaction requires two journal entries: the first entry records the revenue from the sale at the selling price and the second entry decreases the inventory account and records the expense of the sale at cost.

How do you record purchase on account?

Any purchases made with credit can be referred to as “purchased on account.” A business that owes another entity for goods or services rendered will record the total amount as a credit entry to increase accounts payable. The outstanding balance remains until cash is paid, in full, to the entity owed.

How do you record sold merchandise on account?

We can make the journal entry for sold merchandise on account by debiting the sale amount into the accounts receivable and crediting the same amount into the sales revenue. In this journal entry, the sold merchandise on account results in the increase of sales revenue and the increase of accounts receivable.

When merchandise is bought on credit the journal entry to be affected would be?

When a business purchases goods or services on credit, the business will then debit the purchases account, which will increase the business’s assets. The business will also credit the accounts payable account, which will increase the business’s liabilities.

When you purchase merchandise on account from a vendor what do you put in the account title column of the journal?

Steps when journalizing a purchase of merchandise on account 1. Write the date in the date columns 2. write the vendor name in the account credited column 3. Write the purchase invoice number in the Purchase No.

What is the journal entry for purchase goods on credit?

Journal Entry for goods purchased on credit Credit– The Increase in Liability. Debit– All expenses and losses. Credit– The giver.