Does perpetual inventory use LIFO?

Does perpetual inventory use LIFO?

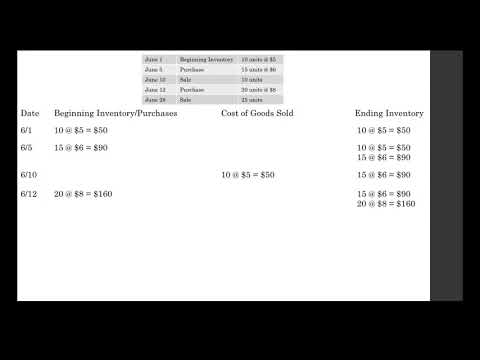

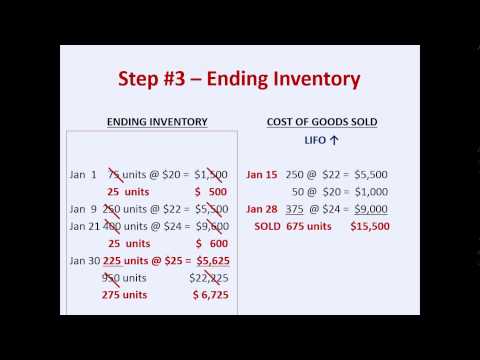

Like first-in, first-out (FIFO), last-in, first-out (LIFO) method can be used in both perpetual inventory system and periodic inventory system. The following example explains the use of LIFO method for computing cost of goods sold and the cost of ending inventory in a perpetual inventory system.

How do you calculate perpetual inventory in FIFO?

What is the LIFO periodic inventory method?

Under a periodic LIFO system, you would wait until the end of the month and then record the sale, which means that you remove five units from the last layer recorded at the end of the month, which results in a charge to the cost of goods sold of $35 (5 units x $7 each).

Is perpetual inventory LIFO or FIFO?

FIFO, LIFO, Perpetual, Periodic Under FIFO, it is assumed that items purchased first are sold first. Under LIFO, it is assumed that items purchased last are sold first. Perpetual inventory system updates inventory accounts after each purchase or sale.

What is perpetual LIFO method?

What Is LIFO Perpetual Inventory Method? LIFO (last-in, first-out) is a cost flow assumption that businesses use to value their stock where the last items placed in inventory are the first items sold. So the remaining inventory at the end of the period is the oldest purchased or produced.

How do you calculate cost of goods sold using LIFO?

With LIFO, you use the last three units to calculate cost of goods sold expense. The ending inventory cost of the one unit not sold is $100, which is the oldest cost. The $412 total cost of the four units acquired less the $312 cost of goods sold expense leaves $100 in the inventory asset account.

Is LIFO perpetual or periodic?

How do you calculate cost of goods sold in a perpetual system?

The cost of goods sold is calculated by adding the beginning inventory and purchases to obtain the cost of goods available for sale and then deducting the ending inventory.

What is a LIFO example?

Based on the LIFO method, the last inventory in is the first inventory sold. This means the widgets that cost $200 sold first. The company then sold two more of the $100 widgets. In total, the cost of the widgets under the LIFO method is $1,200, or five at $200 and two at $100.

How do you calculate FIFO and LIFO?

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

Who uses LIFO inventory method?

The U.S. is the only country that allows LIFO because it adheres to Generally Accepted Accounting Principles (GAAP), rather than the International Financial Reporting Standards (IFRS), the accounting rules followed in the European Union (EU), Japan, Russia, Canada, India, and many other countries.

What is LIFO and FIFO with example?

First-in, first-out (FIFO) assumes the oldest inventory will be the first sold. It is the most common inventory accounting method. Last-in, first-out (LIFO) assumes the last inventory added will be the first sold. Both methods are allowed under GAAP in the United States. LIFO is not allowed for international companies.

How do you calculate LIFO reserve?

Calculating LIFO Reserve When preparing company financials for the LIFO method, the difference in costs in inventory between LIFO and FIFO is the LIFO reserve. Therefore, a company’s LIFO reserve = (FIFO inventory) – (LIFO inventory).