How do I convert net to gross in Excel?

How do I calculate VAT backwards?

To calculate VAT backwards simply : Take the sum you want to work backwards from divide it by 1.2 (1. + VAT Percentage), then subtract the divided number from the original number, that then equals the VAT.

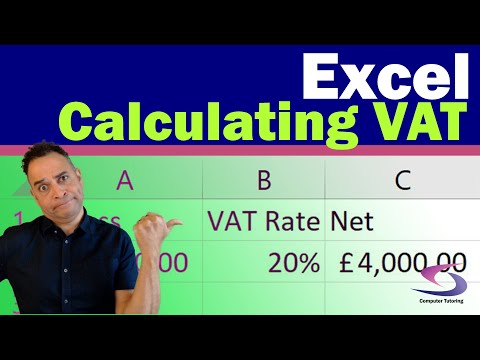

How do I calculate VAT in Excel UK?

How do I calculate net from gross?

Net price is $40 , gross price is $50 and the tax is 25% . You perform a job and your gross pay is $50 . The income tax is 20% , so your net income is $50 – 20% = $50 – $10 = $40 .

How do I calculate net pay from gross UK?

If you have a gross amount and want to determine the net value, then simply divide the gross value by 1.20 to provide the net value. For example, an invoice that includes VAT totalling £150 would have a VAT amount of £25 with the net value at £125.

What is the gross up formula?

Divide desired net by the net tax percentage to get grossed up amount. Example: 5,000/. 73 = 6,849.32 (rounded). Result: If department issues a payment of $6,849.32, the employee will net $5,000.