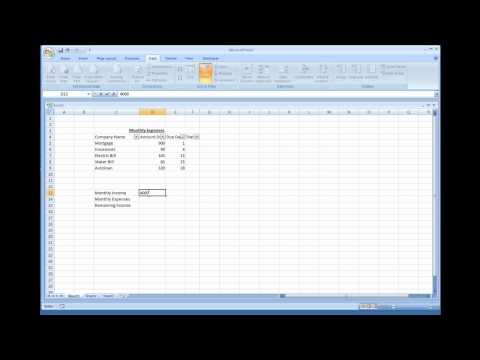

How do I create an expense sheet in Excel?

How do I create an expense sheet in Excel?

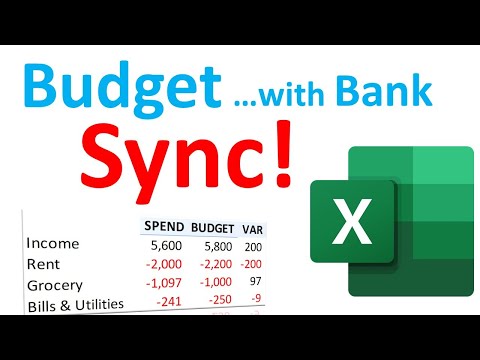

How do I create an expense and income spreadsheet in Excel?

How do I manage my expenses in Excel?

How do I track my small business expenses in Excel?

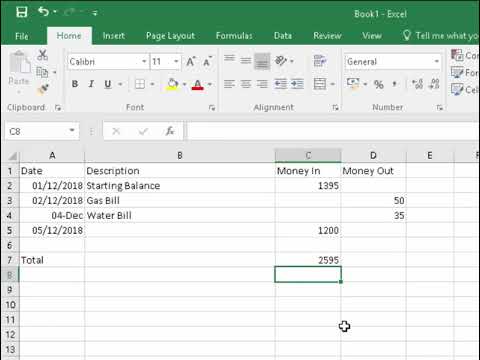

If you want to track business expenses in Excel, you’ll need to create a spreadsheet and fill in the appropriate information. The most important columns are likely to be “date,” “description,” “category,” and “amount.” You can also add additional columns if needed, like “vehicle number” for tracking car expenses.

How do I create a monthly expense spreadsheet?

Table of Contents

- Step 1: Open a Google Sheet.

- Step 2: Create Income and Expense Categories.

- Step 3: Decide What Budget Period to Use.

- Step 4: Use simple formulas to minimize your time commitment.

- Step 5: Input your budget numbers.

- Step 6: Update your budget.

- Bonus: How to Automatically Update your Google Sheet Budget.

How do I track expenses on a spreadsheet?

A spreadsheet that keeps track of expenses can serve as a ledger.

- Use the top row of each column for the categories you’ve defined.

- Use the far left-hand column for the date, and the column second to the left for the name of the vendor.

- Enter the amount of each expense in the column that corresponds to its category.

How do you keep track of expenses?

5 Steps for Tracking Your Monthly Expenses

- Check your account statements. …

- Categorize your expenses. …

- Use a budgeting or expense-tracking app. …

- Explore other expense trackers. …

- Identify room for change.

How do I organize my bills in Excel?

How do you organize small business expenses?

10 Tips To Organize Your Small Business Expenses

- Open Your Business Bank Account. …

- Keep Startup Business Cost Aside. …

- Use a Spreadsheet. …

- Digitize Your Hard Copies. …

- Save and Organize Receipts in Different Locations. …

- Make a Habit To Use Accounting Software.

What is the 70 20 10 Rule money?

70% is for monthly expenses (anything you spend money on). 20% goes into savings, unless you have pressing debt (see below for my definition), in which case it goes toward debt first. 10% goes to donation/tithing, or investments, retirement, saving for college, etc.

What is the 50 20 30 budget rule?

The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

How do I organize my monthly expenses?

5 Easy Ways To Organize Your Monthly Bills

- Use A Printable Checklist. …

- Organize Your Bills Using A Spreadsheet. …

- Use A Budgeting App To Organize Your Monthly Bills. …

- Organize Your Bills Into Envelopes Or Folders. …

- Use A Bill Organization Binder. …

- Other Helpful Tips For Organizing Your Monthly Bills. …

- Bottom Line.

What is the 30 day rule?

With the 30 day savings rule, you defer all non-essential purchases and impulse buys for 30 days. Instead of spending your money on something you might not need, you’re going to take 30 days to think about it. At the end of this 30 day period, if you still want to make that purchase, feel free to go for it.

Which is the best expense tracker?

The Best Expense Tracker Apps for 2022

- Best Overall: Mint.

- Best for Small Businesses: QuickBooks Accounting.

- Best for Investors: Personal Capital.

- Best for Receipt Saving: Expensify.

- Best for Reimbursement and Mileage: Everlance.

- Best Free Option: NerdWallet.