How do I write a transportation invoice?

How do I write a transportation invoice?

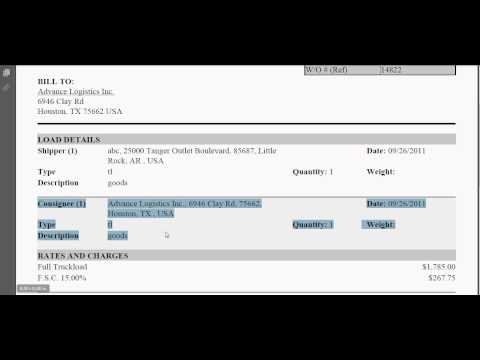

How to Create a Trucking Invoice

- Download the free trucking invoice template.

- Add your business name and contact information.

- Insert business logo and branding.

- Include client’s name or business and contact details.

- Create and include a unique invoice number on the template.

- Add the issue date and due date.

What is an invoice in trucking?

In the trucking business, invoice factoring is also known as freight factoring, transportation factoring, or freight bill factoring. The process works the same with the carrier, delivering a load that sells their invoice to a freight factoring company.

How do I create a transport bill in Excel?

4 Steps of Creating Transport Bill Format in Excel

- Step-1: Input the Details of a Company.

- Step-2: Customer’s Details in the Transport Bill Format.

- Step-3: Use Description of Transportations.

- Step-4: Calculate the SUBTOTAL.

How do I write a logistics invoice?

Logistics Invoice Format

- Name and address of your business in the header section.

- Put your logo alongside your business name, if you have one.

- Client’s name and contact details.

- Description of product or service.

- Per unit price and quantity.

- Details of applicable taxes.

- Net amount.

- Terms of payment and other conditions.

How do I create a dispatch invoice?

How do you fill transport Bilty?

Go to create the option ‘New Bilty’ and fill in your details to digitally create your professional and elegant-looking Bilty. Go to ‘Create New Loading Parchi’ and make a Loading Parchi easily for your truck. Click ‘More Options’ to be able to share your digital Bilty or Loading Parchi with anyone.

What is logistics invoice value?

An Invoice is a document listing the products or services sold, mode of transport used to deliver (if the case) and the payment terms. An invoice is issued by the seller to a buyer. In some cases, the buyer has a limited number of days to settle the payment.

What is the freight bill?

A freight bill is essentially an invoice and they’re different from bills of lading because they wouldn’t serve as evidence in a court of law as proof of shipment in the event of a legal dispute. The freight bill includes all of the details about the transaction and is signed by the shipper and the carrier as well.

What is a freight receipt?

Part of the Freight Term Glossary A Forwarder’s Cargo Receipt (FCR) (AKA Forwarder’s Certificate of Receipt) is a document issued by a freight forwarder to the shipper that serves as certification of the receipt of cargo. Once issued, the consignor assumes full responsibility for the shipment.

How do I format an invoice in Excel?

To create an invoice from an Excel template on a Windows PC, follow these steps:

- Open Microsoft Excel. …

- Search for an Invoice Template. …

- Choose Your Template. …

- Open the Invoice Template. …

- Customize the Invoice. …

- Save the Invoice. …

- Send the Invoice.

How do I download bill format in Excel?

How to Make an Invoice Form in Excel

- Download the free “Excel Invoice Template”

- Open the invoice template .xls in Excel.

- Name your invoice. …

- Customize your Excel invoice with your company details, logo, branding and contact information.

- Create your first client invoice by making a copy and renaming the new document.

How do I format an invoice in Word?

How to Make an Invoice from a Word Template

- Open a New Word Document. …

- Choose Your Invoice Template. …

- Download the Invoice Template. …

- Customize Your Invoice Template. …

- Save Your Invoice. …

- Send Your Invoice. …

- Open a New Blank Document. …

- Create an Invoice Header.

How do I write a commercial invoice for shipping?

How to Make a Commercial Invoice: Step-By-Step Guide

- Download a Commercial Invoice Template. …

- Fill in Seller Details. …

- Fill in Customer Details. …

- Assign an Invoice Number. …

- Include a Customer Reference Number. …

- Include the Terms of Sale. …

- Detail the Terms of Payment. …

- Identify the Currency.

What is invoice in supply chain?

An invoice is a document issued by a seller to the purchaser, describing what has been done or purchased, in what quantities and at what prices. The invoice will also include the agreed payment terms, which will trigger the payment process.

What is FI and MM invoice?

The reason is that SAP® usually creates not one but (at least) two invoice documents whenever an invoice is entered with reference to a purchase order: One is the materials management (MM) version of the invoice; the other document is the financial (F) version of the invoice.

How do I invoice an owner operator?

These simple steps make trucking invoices painless….Details of the job that was completed:

- From (shipper, city, state)

- To (consignee, city, state)

- The name of the driver.

- The truck number and trip number (if applicable)

- The activity completed (what type of load if was) and the rate.

What is invoice copy?

Legal: invoice copy protects small businesses from fraudulent or small civil lawsuit as it is clear evidence that the goods or services were delivered at a particular time. Without this invoice copy, there won’t be any record of that transaction.

Is GST compulsory for transporter?

A transporter must obtain a GST registration based on their aggregate turnover exceeding INR 20 lakhs or INR 10 lakhs for a unique category in a financial year. GTA has to pay 12% GST on all the GTA services for the financial year provided by them.

Is GST applicable on transport services?

no. 11, (i) Services of goods transport agency (GTA) in relation to transportation of goods (including used household goods for personal use) (Heading 9965 &9967 respectively) attracts GST @2.5% or 6% CGST. Identical rate would be applicable for SGST also, taking the effective rate to 5% or 12%.

How do I add transport charges to GST invoice?

How To Add Transport Charges in GST Invoice TallyPrime

- Enter gateway of TallyPrime.

- Select Company.

- Under Masters, Create ledger, …

- Click Yes to save the new ledger created.

- Visit back gateway of TallyPrime and now select the Accounting Voucher tile.