How do you calculate cost of sales business GCSE?

How do you calculate cost of sales business GCSE?

What is cost of sales in business GCSE?

The money received from selling goods and services is sales revenue . The cost of making the goods or providing the services is called the cost of sales , since it reflects the variable costs directly related to production, such as raw materials.

How do you calculate total cost GCSE?

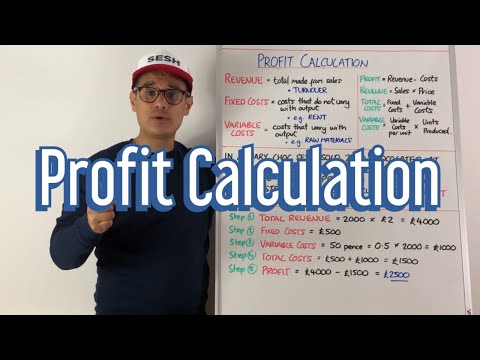

Total costs = fixed costs + variable costs Question

- The total fixed costs incurred by the sandwich shop.

- The total variable costs incurred by the sandwich shop.

- The total costs incurred by the sandwich shop.

What is cost of sales BBC Bitesize?

Cost of sales – This is the direct cost of the goods that have been sold for example the raw materials used to make the product.

What is the formula for cost of sales?

Cost of sales ratio formula To calculate the total values of sales, multiply the average price per product or service sold by the number of products or services sold. Multiplying by 100 turns your figure into a percentage.

How do you find the cost of sales?

Cost of Sales = Beginning Inventory + Raw Material Purchase + Cost of Direct Labor + Overhead Manufacturing Cost – Ending Inventory

- Cost of Sales = $20,000 + $100,000 + $70,000 + $60,000 – $15,000.

- Cost of Sales= $235,000.

What is the cost of sale?

Cost of sales (COS) indicates how much a retail or wholesale business spends on the products it purchases from suppliers for resale. Cost of sales appears as a direct cost on the income statement. It is used only by companies that do not manufacture their own products for sale.

What is cost of sales examples?

For example, if 500 units are made or bought but inventory rises by 50 units, then the cost of 450 units is cost of goods sold. If inventory decreases by 50 units, the cost of 550 units is cost of goods sold.

How do you calculate cost of sales on an income statement?

One relatively simple way to determine the cost of goods sold is to compare inventory at the start and end of a given period using the formula: COGS = Beginning Inventory + Additional Inventory – Ending Inventory.

How do you calculate total cost?

Total Cost = Total Fixed Cost + Average Variable Cost Per Unit * Quantity of Units Produced

- Total Cost = $10,000 + $5 * $5,000.

- Total Cost = $35,000.

How do you calculate sales revenue BBC Bitesize?

In short, revenue = price x quantity. For example, the total revenue raised by selling 2,000 items priced £30 each is 2,000 x £30 = £60,000. Revenue is sometimes called sales, sales revenue, total revenue or turnover.

How do you calculate the cost of a business?

To find your net income or earnings, you need to know your total business revenue and expenses (including the cost of goods sold). Add up your company’s costs, like office supplies, operating expenses, payroll costs and business loan payments. Then, use this formula: Net Income = Revenue – Expenses.

Is Cost of revenue the same as COGS?

Cost of revenue is different from cost of goods sold (COGS) because the former also includes costs outside of production, such as distribution and marketing. The cost of revenue takes into account the cost of goods sold (COGS) or cost of services provided plus any additional costs incurred to generate a sale.

How do you calculate total profit GCSE?

Gross profit = Total revenue – Cost of sales

- Gross profit = sales revenue – cost of sales.

- Gross profit = £100,000 – £28,000.

- Gross profit = £72,000.

Are wages included in cost of sales?

When the products are sold, the costs assigned to those products (including the manufacturing salaries and wages) are included in the cost of goods sold, which is reported on the income statement.

What is COGS and how is it calculated?

Cost of goods sold (COGS) is calculated by adding up the various direct costs required to generate a company’s revenues. Importantly, COGS is based only on the costs that are directly utilized in producing that revenue, such as the company’s inventory or labor costs that can be attributed to specific sales.