How do you calculate FIFO perpetual inventory?

How do you calculate FIFO perpetual inventory?

Is perpetual inventory system FIFO?

The Fine Electronics company uses perpetual inventory system to account for acquisition and sale of inventory and first-in, first-out (FIFO) method to compute cost of goods sold and for the valuation of ending inventory.

Is FIFO periodic and perpetual the same?

With perpetual FIFO, the first (or oldest) costs are the first removed from the Inventory account and debited to the Cost of Goods Sold account. Therefore, the perpetual FIFO cost flows and the periodic FIFO cost flows will result in the same cost of goods sold and the same cost of the ending inventory.

What is the FIFO method formula?

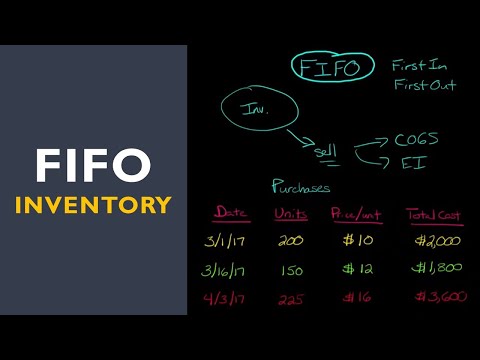

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

What is FIFO method with example?

Example of FIFO Imagine if a company purchased 100 items for $10 each, then later purchased 100 more items for $15 each. Then, the company sold 60 items. Under the FIFO method, the cost of goods sold for each of the 60 items is $10/unit because the first goods purchased are the first goods sold.

How do you calculate cost of goods sold and ending inventory using FIFO?

Is LIFO a perpetual inventory method?

Like first-in, first-out (FIFO), last-in, first-out (LIFO) method can be used in both perpetual inventory system and periodic inventory system. The following example explains the use of LIFO method for computing cost of goods sold and the cost of ending inventory in a perpetual inventory system.

What is perpetual inventory method?

Perpetual inventory is a continuous accounting practice that records inventory changes in real-time, without the need for physical inventory, so the book inventory accurately shows the real stock. Warehouses register perpetual inventory using input devices such as point of sale (POS) systems and scanners.