How do you calculate lease payments on equipment?

How do you calculate lease payments on equipment?

Use the equation associated with calculating equipment lease payments. Payment = Present Value – (Future Value / ( ( 1 + i ) ^n) / [ 1- (1 / (1 +i ) ^ n ) ] / i. In this equation, “i” represent the interest rate as a monthly decimal. Convert the interest rate to a monthly decimal.

What is a good interest rate for equipment lease?

Equipment Leasing Examples Note that typical interest rates for equipment leases are between 7% and 16%, with down payments for well-qualified borrowers starting at 5%. Lease terms are typically between two and five years and can go up to 90% of the estimated life of the equipment.

How is lease amount calculated?

The lease calculator shows you the monthly lease payments and the total interest amount in seconds. You may use the mathematical formula to calculate the monthly lease payments. PMT = PV – FV / [(1+i)^n / (1 – (1 / (1+i)^n / i)] For example, the cost of the leased asset is Rs 2,00,000. The residual value is Rs 50,000.

How does equipment lease financing work?

In simple terms, equipment leasing has some similarities to an equipment loan, however it’s the lender that buys the equipment and then leases (rents) it back to you for a flat monthly fee. Most equipment leases come at a fixed interest rate and fixed term to keep those payments the same every month.

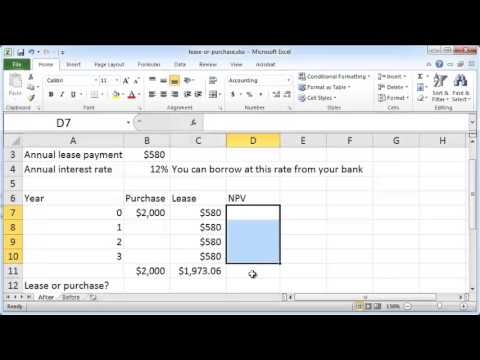

How do you calculate equipment lease in Excel?

What is the average lease interest rate?

Financing Offers by Car Manufacturer

| Car Manufacturer | Financing APR Q1 2022 | Lease APR (inferred interest rate) Q1 2022 |

|---|---|---|

| Toyota | 4.50% | 6.25% |

| Volkswagen | 4.25% | 7.06% |

| Chevrolet | 2.90% | 4.68% |

| Hyundai | 0.00% | 6.02% |

What is the average interest rate for equipment loan?

Equipment Loan Qualifications Loan amounts typically range between $10,000 and $500,000 with interest rates of 6% to 9% and terms of two to seven years. Borrowers should expect to put between 5% to 20% down on the purchase.

What are the different types of equipment leases?

Learn more about Equipment Leasing!

- Sale/Leaseback: (allows you to use your equipment to get working capital) …

- True Lease or Operating Equipment Leases: (Also known as fair market value leases) …

- The “P.U.T.” Option Lease (Purchase upon Termination) …

- TRAC Equipment Leases.

Which alternative lender is best for equipment?

With fast funding, low interest rates and several equipment financing options, Crest Capital checks off all the boxes for a variety of small business borrowers. For these reasons, Crest Capital is our pick for the best alternative lender for equipment financing.

Are equipment leases good?

Because of the high costs of owning and operating equipment, many small business owners opt to lease. Leasing offers advantages that owning does not, including lower monthly payments typically spread over months or years rather than delivered in a lump sum.

Is it hard to get financed for equipment?

Qualifying for equipment financing is easier than you might think. Typically, you’ll need to have been in business for at least a year, $50,000 or more in annual revenue, and a credit score of 650 or higher. Because the collateral is often part of your loan, it’s not as difficult to obtain as other types of financing.

Can you depreciate leased equipment?

An Operating Lease is generally viewed as a rental. The leased equipment is neither shown as a liability nor an asset on the lessee’s (company making the lease payments) balance sheet, and the lessee cannot take advantage of depreciation and similar.

How do you calculate the NPV of a lease?

Review the calculation to determine NPV. The formula for finding the net present value of future lease payments on a contract is: (PV) = C * [(1 – (1 + i)^ – n) / i]. PV = present value, C = the cash flow each period, i = the prevailing interest rate and n = number of lease payments.

What is the PMT formula?

=PMT(rate, nper, pv, [fv], [type]) The PMT function uses the following arguments: Rate (required argument) – The interest rate of the loan. Nper (required argument) – Total number of payments for the loan taken.

Are leases worth it?

On the surface, leasing can be more appealing than buying. Monthly payments are usually lower because you’re not paying back any principal. Instead, you’re just borrowing and repaying the difference between the car’s value when new and the car’s residual—its expected value when the lease ends—plus finance charges.

What is the money factor on a lease?

The money factor is the financing charge a person will pay on a lease. It is similar to the interest rate paid on a loan, and it is also based on a customer’s credit score. It is commonly depicted as a very small decimal that begins in the thousandth place (i.e., 0.00#).

Should you put money down on a lease?

A Down Payment Doesn’t Lower the Lease Price In a car lease, a down payment is often called a capitalized cost reduction, or cap cost reduction. Putting money down on a car lease isn’t typically required unless you have bad credit. If you aren’t required to make a down payment on a lease, you generally shouldn’t.