How do you calculate LIFO ending inventory?

How do you calculate LIFO ending inventory?

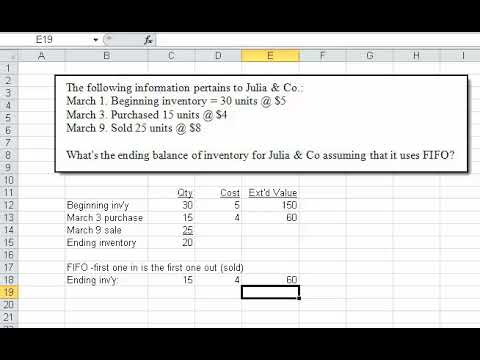

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

What is the formula for ending inventory?

What is included in ending inventory? The basic formula for calculating ending inventory is: Beginning inventory + net purchases – COGS = ending inventory. Your beginning inventory is the last period’s ending inventory. The net purchases are the items you’ve bought and added to your inventory count.

How do you calculate ending inventory using FIFO?

What is FIFO and LIFO example?

First-in, first-out (FIFO) assumes the oldest inventory will be the first sold. It is the most common inventory accounting method. Last-in, first-out (LIFO) assumes the last inventory added will be the first sold. Both methods are allowed under GAAP in the United States. LIFO is not allowed for international companies.

Who uses LIFO inventory method?

The U.S. is the only country that allows LIFO because it adheres to Generally Accepted Accounting Principles (GAAP), rather than the International Financial Reporting Standards (IFRS), the accounting rules followed in the European Union (EU), Japan, Russia, Canada, India, and many other countries.

How do you calculate ending inventory without purchases?

How do you find ending inventory without the cost of goods sold? Ending inventory = cost of goods available for sale less the cost of goods sold.

What is the ending inventory balance?

Materials inventory ending balance is equal to its beginning balance plus the cost of materials purchased less the cost of materials used. Work in process ending inventory balance is equal to its beginning balance plus total manufacturing costs less the cost of goods manufactured.

Does LIFO or FIFO have higher ending inventory?

If prices are rising through the year, using the recent inventory LIFO method will result in a higher COGS and lower ending inventory value than with the FIFO method. Using the LIFO accounting method here would yield lower profits and lower taxable income.

What is LIFO explain with an example?

LIFO stands for “Last-In, First-Out”. It is a method used for cost flow assumption purposes in the cost of goods sold calculation. The LIFO method assumes that the most recent products added to a company’s inventory have been sold first. The costs paid for those recent products are the ones used in the calculation.

What is FIFO inventory method?

FIFO (first in, first out) inventory management seeks to sell older products first so that the business is less likely to lose money when the products expire or become obsolete. LIFO (last in, first out) inventory management applies to nonperishable goods and uses current prices to calculate the cost of goods sold.

What is the total cost of the ending inventory according to LIFO?

According to the LIFO method, the last units purchased are sold first, so the value used for the ending inventory formula is based on the cost of the oldest units. This means that the ending inventory for this period for Invest Media would be 2,250 x 10 = $22,500.

Why LIFO method is not used?

IFRS prohibits LIFO due to potential distortions it may have on a company’s profitability and financial statements. For example, LIFO can understate a company’s earnings for the purposes of keeping taxable income low. It can also result in inventory valuations that are outdated and obsolete.

Why LIFO is better than FIFO?

FIFO focuses on using up old stock first, whilst LIFO uses the newest stock available. LIFO helps keep tax payments down, but FIFO is much less complicated and easier to work with.