How do you calculate LIFO perpetual inventory?

How do you calculate LIFO perpetual inventory?

Does perpetual inventory use LIFO?

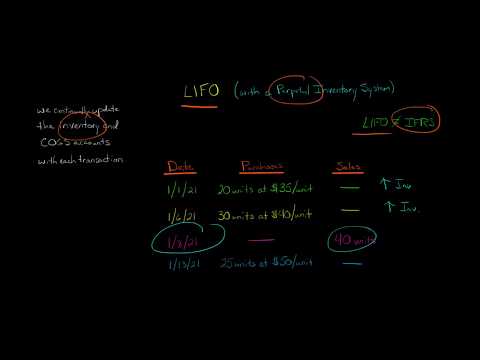

Like first-in, first-out (FIFO), last-in, first-out (LIFO) method can be used in both perpetual inventory system and periodic inventory system. The following example explains the use of LIFO method for computing cost of goods sold and the cost of ending inventory in a perpetual inventory system.

Is perpetual inventory LIFO or FIFO?

FIFO, LIFO, Perpetual, Periodic Under FIFO, it is assumed that items purchased first are sold first. Under LIFO, it is assumed that items purchased last are sold first. Perpetual inventory system updates inventory accounts after each purchase or sale.

What is the difference between LIFO periodic and perpetual?

With periodic LIFO, the latest costs are assumed to be removed from inventory at the end of the accounting year. With perpetual LIFO the latest costs are removed from inventory at the time of each sale.

What is perpetual inventory method?

A perpetual inventory system is an inventory management method that records when stock is sold or received in real-time through the use of an inventory management system that automates the process. A perpetual inventory system will record changes in inventory at the time of the transaction.

What is the FIFO perpetual inventory method?

Perpetual FIFO is a cost flow tracking system under which the first unit of inventory acquired is presumed to be the first unit consumed or sold.

How do you use LIFO inventory method?

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

What products use LIFO?

For example, many supermarkets and pharmacies use LIFO cost accounting because almost every good they stock experiences inflation. Many convenience stores—especially those that carry fuel and tobacco—elect to use LIFO because the costs of these products have risen substantially over time.

What is a LIFO example?

Based on the LIFO method, the last inventory in is the first inventory sold. This means the widgets that cost $200 sold first. The company then sold two more of the $100 widgets. In total, the cost of the widgets under the LIFO method is $1,200, or five at $200 and two at $100.

What is LIFO perpetual?

What Is LIFO Perpetual Inventory Method? LIFO (last-in, first-out) is a cost flow assumption that businesses use to value their stock where the last items placed in inventory are the first items sold. So the remaining inventory at the end of the period is the oldest purchased or produced.

What is FIFO and LIFO?

FIFO stands for “first in, first out” and assumes the first items entered into your inventory are the first ones you sell. LIFO, also known as “last in, first out,” assumes the most recent items entered into your inventory will be the ones to sell first.

What is perpetual inventory system example?

What Is Perpetual Inventory System Example? The most common perpetual inventory system example is the usage of wireless barcode scanners in a grocery store. It records all scanned transactions on the system immediately as they occur. This way, firms can easily compute the current and required stockpile.

How do you know if its perpetual or periodic?

A perpetual inventory system inventory updates purchase and sales records constantly, particularly impacting Merchandise Inventory and Cost of Goods Sold. A periodic inventory system only records updates to inventory and costs of sales at scheduled times throughout the year, not constantly.

What is the difference between the periodic and perpetual FIFO?

With perpetual FIFO, the first (or oldest) costs are the first removed from the Inventory account and debited to the Cost of Goods Sold account. Therefore, the perpetual FIFO cost flows and the periodic FIFO cost flows will result in the same cost of goods sold and the same cost of the ending inventory.

What are the 2 types of inventory systems?

Two types of inventory are periodic and perpetual inventory. Both are accounting methods that businesses use to track the number of products they have available.

What are the 4 types of inventory?

There are four main types of inventory: raw materials/components, WIP, finished goods and MRO.

Who uses perpetual inventory system?

So, for the most part, large businesses with a high number of sales and several retail outlets, such as pharmacies, and grocery stores require a perpetual inventory system.

What is another name for perpetual inventory system?

In business and accounting/accountancy, perpetual inventory or continuous inventory describes systems of inventory where information on inventory quantity and availability is updated on a continuous basis as a function of doing business.