How do you do FIFO periodic inventory?

How do you do FIFO periodic inventory?

What is periodic inventory system in FIFO?

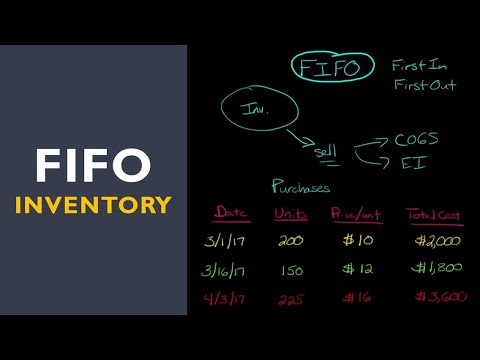

What is the Periodic FIFO Method? Periodic FIFO is a cost flow tracking system that is used within a periodic inventory system. Under a periodic system, the ending inventory balance is only updated when there is a physical inventory count.

How do you find the periodic ending inventory in FIFO?

According to the FIFO method, the first units are sold first, and the calculation uses the newest units. So, the ending inventory would be 1,500 x 10 = 15,000, since $10 was the cost of the newest units purchased. The ending inventory for Harod’s company would be $15,000.

What is FIFO method with example?

Example of FIFO Imagine if a company purchased 100 items for $10 each, then later purchased 100 more items for $15 each. Then, the company sold 60 items. Under the FIFO method, the cost of goods sold for each of the 60 items is $10/unit because the first goods purchased are the first goods sold.

How do you calculate cost of goods sold using FIFO periodic?

To calculate COGS (Cost of Goods Sold) using the FIFO method, determine the cost of your oldest inventory. Multiply that cost by the amount of inventory sold. Please note: If the price paid for the inventory fluctuates during the specific time period you are calculating COGS for, that must be taken into account too.

What is periodic inventory system with example?

Example of Periodic Systems. Periodic system examples include accounting for beginning inventory and all purchases made during the period as credits. Companies do not record their unique sales during the period to debit but rather perform a physical count at the end and from this reconcile their accounts.

How do you calculate periodic inventory?

Starting inventory (based on the last physical inventory) plus the total number of purchases made within the period between the previous physical inventory and the next physical inventory is equal to the total amount of the goods that are available to be sold.

What is periodic order method?

A periodic inventory system or the periodic inventory method is an accounting method in which you determine the amount of inventory at the end of each accounting period or in specified periods. Furthermore, a periodic inventory system requires a physical count for each period.

What is FIFO and LIFO example?

First-in, first-out (FIFO) assumes the oldest inventory will be the first sold. It is the most common inventory accounting method. Last-in, first-out (LIFO) assumes the last inventory added will be the first sold. Both methods are allowed under GAAP in the United States. LIFO is not allowed for international companies.

What is the FIFO method first in first out?

FIFO stands for first in, first out, an easy-to-understand inventory valuation method that assumes that goods purchased or produced first are sold first. In theory, this means the oldest inventory gets shipped out to customers before newer inventory.

How do you calculate cost of goods sold in a periodic system?

The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the ending inventory for the period. The cost of goods sold equation might seem a little strange at first, but it makes sense.

What are some product examples that would use a period inventory system?

One example of a business that would use a periodic system is a food bank. They would frequently count the physical inventory to determine the closing inventory quantity.”

What is difference between perpetual and periodic inventory system?

A perpetual inventory system inventory updates purchase and sales records constantly, particularly impacting Merchandise Inventory and Cost of Goods Sold. A periodic inventory system only records updates to inventory and costs of sales at scheduled times throughout the year, not constantly.