How do you solve a perpetual inventory system?

How do you solve a perpetual inventory system?

How do you calculate cost of goods sold in a perpetual inventory system?

The cost of goods sold is calculated by adding the beginning inventory and purchases to obtain the cost of goods available for sale and then deducting the ending inventory.

What is one disadvantage of the perpetual inventory system?

One disadvantage of a perpetual inventory system involves the setup cost. Most systems require the purchase of new equipment and inventory software. This equipment includes point of sale scanners which read the bar code of each item. Scanners are also required when items are received into inventory.

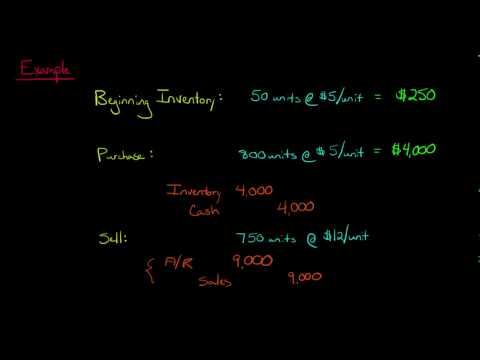

What is perpetual inventory system with example?

A perpetual inventory system keeps continual track of your inventory balances. Updates are automatically made when you receive or sell inventory. Purchases and returns are immediately recorded in your inventory accounts. For example, a grocery store may use a perpetual inventory system.

How do you calculate perpetual inventory using FIFO?

How do you calculate cost of goods sold and ending inventory using FIFO?

How Do You Calculate FIFO? To calculate COGS (Cost of Goods Sold) using the FIFO method, determine the cost of your oldest inventory. Multiply that cost by the amount of inventory sold.

How do you calculate perpetual cost?

How do I calculate inventory?

The basic formula for calculating ending inventory is: Beginning inventory + net purchases – COGS = ending inventory. Your beginning inventory is the last period’s ending inventory. The net purchases are the items you’ve bought and added to your inventory count.

What is the formula to calculate purchases?

Answer:

- Obtain the total valuation of beginning inventory, ending inventory, and the cost of goods sold.

- Subtract beginning inventory from ending inventory.

- Add the cost of goods sold to the difference between the ending and beginning inventories.

What are the pros and cons of perpetual inventory system?

Advantages and Disadvantages of Perpetual Inventory System

- Advantages of Perpetual Inventory System. Real-Time Updates. Managing Multiple Locations Easily. More Informed Forecasting. …

- Disadvantages of Perpetual Inventory System. Expensive Technique. Breakages and Spoilage Not Accounted For.

What do you think are the advantages and disadvantages in using the perpetual inventory system and the periodic inventory system?

While periodic inventories are the cheaper process, conducting one for a larger business might prove to be an arduous task as it is time-consuming and requires dedicated manpower. On the other hand, a perpetual inventory system can be faster but more costly in some instances.

What do you mean by perpetual inventory system advantages and disadvantages?

Perpetual Inventory System is a system of stock control in which continuous record of receipt and issue of materials is maintained by the stores department. It shows the physical movement of stocks and their current balance. A perpetual inventory system is usually supported by a programmed of continuous stock-taking.

What types of businesses use the perpetual inventory system?

When business owners or management need up-to-date information about inventory levels, then using a perpetual inventory system is the way to go. So, for the most part, large businesses with a high number of sales and several retail outlets, such as pharmacies, and grocery stores require a perpetual inventory system.

What accounts are used in a perpetual inventory system?

Perpetual inventory system provides a running balance of cost of goods available for sale and cost of goods sold. Under this system, no purchases account is maintained because inventory account is directly debited with each purchase of merchandise.

What is another name for perpetual inventory system?

In business and accounting/accountancy, perpetual inventory or continuous inventory describes systems of inventory where information on inventory quantity and availability is updated on a continuous basis as a function of doing business.