How is equivalent pay calculated?

How is equivalent pay calculated?

Say your employee earns $50,000 a year, and she works a 40-hour week, her hourly pay is the annual amount divided by 2,080 hours (50,000/2,080 = 24.038, which you can round up to 24.04). For the employee’s daily rate of pay, simply multiply 24.04 by the number of hours worked each day.

How do I work out my full-time equivalent salary UK?

What is the Inhand salary in Germany?

Average income in Germany According to the Federal Statistical Office of Germany, in 2020 the average gross annual salary was 47.700 euros, or 3.975 euros per month.

What is US equivalent salary in India?

So if you are drawing a salary of USD 100,000 in the US, you can expect to draw Rs 21 lakh in India, give or take. At an exchange rate of Rs 45, that would translate to an Indian salary of USD 46,666 or 46% of the US salary.

What is a notional salary?

The term ‘notional payment’ applies to a range of payments made to employees that are not in the form of cash but which must be treated as cash for purposes of pay as you earn (PAYE) and National Insurance contributions (NICs).

How is basic salary calculated?

Ideally, they use a reversed calculation method where a percentage of the salary and CTC is taken. The basic pay is usually 40% of gross income or 50% of an individual’s CTC. Basic salary = Gross pay- total allowances (medical insurance, HRA, DA, conveyance, etc.)

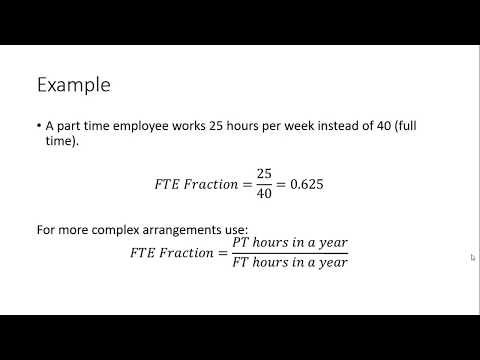

How do you calculate a full-time equivalent?

The calculation of full-time equivalent (FTE) is an employee’s scheduled hours divided by the employer’s hours for a full-time workweek. When an employer has a 40-hour workweek, employees who are scheduled to work 40 hours per week are 1.0 FTEs. Employees scheduled to work 20 hours per week are 0.5 FTEs.

What is the full-time equivalent salary?

Wage in full-time equivalent (FTE) is a wage converted to a full-time throughout the full year, regardless of the actual workload.

How do you work out someone’s full-time equivalent?

To obtain the full time Equivalent for a month, divide the total number of hours by 173.33 (2,080 hours / 12 months). To find the equivalent of a full-time day, divide the total number of hours by 8. The result is the full-time equivalent of 9.04.

Is 40 000 euro a good salary in Germany?

Furthermore, the annual gross salary above 50,000 EUR is considered to be good in Germany. The 2022 Salary Report has shown that the gross average salary in Germany across all jobs is around 51,010 EUR, while the median is 44,074 EUR.

Is 75k euro a good salary in Germany?

It is a salary that comfortably puts you in the top third of earners in Berlin. You won’t quite be able to afford a positively huge flat wherever you’d like, but a normal-sized one pretty much anywhere, or a rather large one in all but the most expensive areas will be comfortably within reach.

Is 70000 Euro a good salary in Munich?

In Munich, the average salary for a professional with experience is around 50,000 EUR – 70,000 EUR. Senior-level executives enjoy a higher income of 65,000 EUR – 100,000 EUR.

Is 45 lakhs good salary in India?

Rs. 45 Lakh/year is Rs 262500 per month after taxes! It’s quite a good salary for Bangalore but not great, especially if you are moving from a 80 Lakh bracket!

What is a good salary in USA?

According to the census, the median household income in 2020 was $67,521. A living wage would fall below this number while an ideal wage would exceed this number. Given this, a good salary would be $75,000.

Is America costly than India?

Cost of living in United States is 221% more expensive than in India.

How do you calculate notional?

To calculate the notional value of a futures contract, the contract size is multiplied by the price per unit of the commodity represented by the spot price. Notional value helps investors understand and plan for risk of loss.

What is notional income UK?

Notional income is income that you’re treated as having which you may not in fact have. Include. Notes. Trust income that under Income Tax rules is treated as the income of another person. For example, investment income of a child where you’ve provided trust funds of more than £100.

What does NP mean on payslip?

Understanding your payslip. Pensionable Pay – ‘P’ or ‘PENS’ at the side of any payment indicates that it is pensionable. ‘NP’ at the side of any payment indicates that it is not pensionable.