Is perpetual inventory system FIFO?

Is perpetual inventory system FIFO?

The Fine Electronics company uses perpetual inventory system to account for acquisition and sale of inventory and first-in, first-out (FIFO) method to compute cost of goods sold and for the valuation of ending inventory.

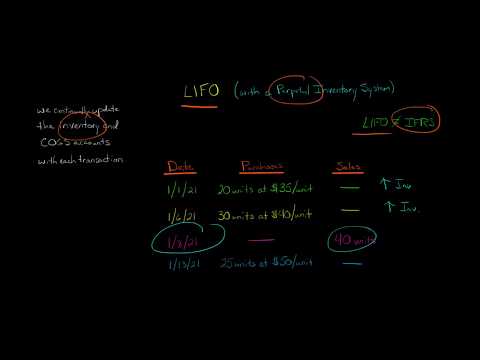

Is perpetual inventory is LIFO?

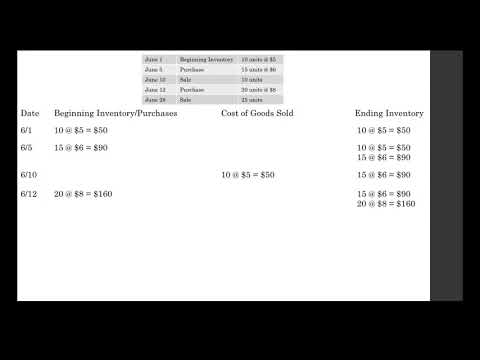

With perpetual LIFO, the last costs available at the time of the sale are the first to be removed from the Inventory account and debited to the Cost of Goods Sold account. Since this is the perpetual system we cannot wait until the end of the year to determine the last cost (as is done with periodic LIFO).

Is LIFO and periodic perpetual the same?

The difference between periodic LIFO and perpetual LIFO involves the time at which the latest inventory costs are removed from the inventory account: With periodic LIFO, the latest costs are assumed to be removed from inventory at the end of the accounting year.

What is perpetual LIFO method?

What Is LIFO Perpetual Inventory Method? LIFO (last-in, first-out) is a cost flow assumption that businesses use to value their stock where the last items placed in inventory are the first items sold. So the remaining inventory at the end of the period is the oldest purchased or produced.

How do you do LIFO perpetual inventory?

How do you calculate perpetual inventory in FIFO?

What is perpetual FIFO?

Perpetual FIFO is a cost flow tracking system under which the first unit of inventory acquired is presumed to be the first unit consumed or sold.

What is perpetual inventory system example?

What Is Perpetual Inventory System Example? The most common perpetual inventory system example is the usage of wireless barcode scanners in a grocery store. It records all scanned transactions on the system immediately as they occur. This way, firms can easily compute the current and required stockpile.

What is the FIFO method?

FIFO (first in, first out) inventory management seeks to sell older products first so that the business is less likely to lose money when the products expire or become obsolete. LIFO (last in, first out) inventory management applies to nonperishable goods and uses current prices to calculate the cost of goods sold.

What is the difference between perpetual and periodic inventory system?

A perpetual inventory system inventory updates purchase and sales records constantly, particularly impacting Merchandise Inventory and Cost of Goods Sold. A periodic inventory system only records updates to inventory and costs of sales at scheduled times throughout the year, not constantly.

When would you use a perpetual inventory system?

A perpetual inventory system is an inventory management method that records when stock is sold or received in real-time through the use of an inventory management system that automates the process. A perpetual inventory system will record changes in inventory at the time of the transaction.

When the FIFO inventory cost flow method is used a perpetual inventory system would?

During periods of rising prices, when the FIFO inventory method is used, a perpetual inventory system results in an ending inventory cost that is the same as in a periodic inventory system.

What accounts are used in a perpetual inventory system?

The journal entries used when bookkeeping in the perpetual inventory system are different compared to the ones used in a periodic system.

- To record inventory purchases: Inventory. Debit. …

- To record inventory sales: Accounts Receivable/Cash. Debit. …

- To record theft/breakage: Loss of Inventory Expense. Debit.

How do you use FIFO inventory?

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.