What is an example of a perpetual inventory system?

What is an example of a perpetual inventory system?

The most common perpetual inventory system example is the usage of wireless barcode scanners in a grocery store. It records all scanned transactions on the system immediately as they occur. This way, firms can easily compute the current and required stockpile.

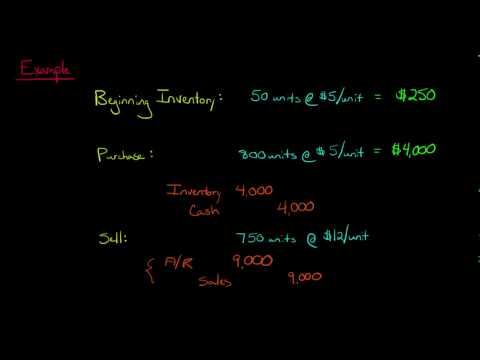

How do you Journalize transactions using a periodic inventory system?

In a periodic system, you enter transactions into the accounting journal. This journal shows your company’s debits and credits in a simple column form, organised by date. Record the purchase of inventory in a journal entry by debiting the purchase account and crediting accounts payable.

How do you account for perpetual inventory?

How do you calculate perpetual inventory using FIFO?

How do you Journalize beginning inventory?

Write “inventory” directly below the entry for “income summary.” Indicate the amount of beginning inventory in the credit column, which equals the debit entry for “income summary.” If a company debits “income summary” for $30,000, it must credit “inventory” for $30,000.

What is perpetual inventory method?

A perpetual inventory system is an inventory management method that records when stock is sold or received in real-time through the use of an inventory management system that automates the process. A perpetual inventory system will record changes in inventory at the time of the transaction.

What is FIFO method with example?

Example of FIFO Imagine if a company purchased 100 items for $10 each, then later purchased 100 more items for $15 each. Then, the company sold 60 items. Under the FIFO method, the cost of goods sold for each of the 60 items is $10/unit because the first goods purchased are the first goods sold.

How do you calculate FIFO and LIFO?

To calculate FIFO (First-In, First Out) determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold, whereas to calculate LIFO (Last-in, First-Out) determine the cost of your most recent inventory and multiply it by the amount of inventory sold.

What are the journal entries for inventory?

Here are some examples of journal inventory entries to help you track your inventory earnings and expenses:

- Inventory purchase entry. …

- Indirect productions cost record. …

- Production labor record. …

- Raw materials entry. …

- Scrap and spoiled inventory record. …

- Record of finished goods. …

- Allocate overhead. …

- Sales transaction record.

What is journal entry for inventory sold?

A sales journal entry is a journal entry in the sales journal to record a credit sale of inventory. All of the cash sales of inventory are recorded in the cash receipts journal and all non-inventory sales are recorded in the general journal.

What is included in a perpetual inventory record?

What is Perpetual Inventory? Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

How do you record freight in a perpetual inventory system?

As mentioned, under the perpetual inventory system, the company needs to record the freight-in cost as a part of the inventory cost. Likewise, the company needs to make the freight-in journal entry in this case, by debiting the freight-in cost into the inventory account and crediting the cash account.

What are the 4 types of inventory?

There are four main types of inventory: raw materials/components, WIP, finished goods and MRO.