What is LIFO method example?

What is LIFO method example?

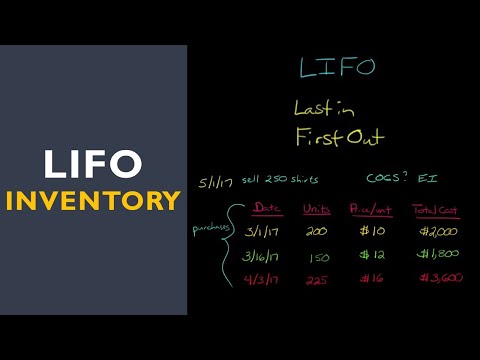

Based on the LIFO method, the last inventory in is the first inventory sold. This means the widgets that cost $200 sold first. The company then sold two more of the $100 widgets. In total, the cost of the widgets under the LIFO method is $1,200, or five at $200 and two at $100.

How do you calculate cost of sales using LIFO?

How is LIFO gross margin calculated?

Calculate gross profit by deducting cost of sales from total revenues. Using the LIFO example, if the business had made $400 through selling its 15 units, its total revenue is $400 and thus its gross profit after subtracting the $210 is $190.

What is LIFO FIFO method?

Key Takeaways. The Last-In, First-Out (LIFO) method assumes that the last unit to arrive in inventory or more recent is sold first. The First-In, First-Out (FIFO) method assumes that the oldest unit of inventory is the sold first.

How do you calculate LIFO reserve?

Calculating LIFO Reserve When preparing company financials for the LIFO method, the difference in costs in inventory between LIFO and FIFO is the LIFO reserve. Therefore, a company’s LIFO reserve = (FIFO inventory) – (LIFO inventory).

Who uses LIFO method?

Here are some of the industries that often use the LIFO method: Automotive industries when needing to quickly ship. Petroleum-based production companies. Pharmaceutical industries with some products.