What is the formula for net sales?

What is the formula for net sales?

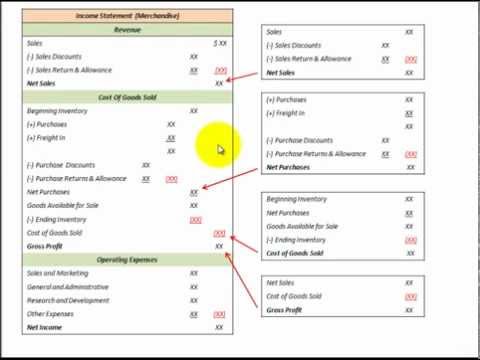

Net Sales = Gross Sales – Returns – Allowances – Discounts When the difference between a business’s gross and net sales is greater than the industry average, the company may be offering higher discounts or experiencing an excessive amount of returns compared to their industry counterparts.

How do merchandising businesses get net sales?

Net sales = Sales revenue – Sales discounts – Sales returns and allowances. Gross margin = Net sales – Cost of goods sold. Total Operating Expenses = Selling expenses + Administrative expenses.

How do you calculate net sales and net purchases?

Net purchases is found by subtracting the credit balances in the purchases returns and allowances and purchases discounts accounts from the debit balance in the purchases account The cost of goods purchased equals net purchases plus the freight‐in account’s debit balance.

What is the formula for net income for a merchandiser?

Summary. To summarize the important relationships in the income statement of a merchandising firm in equation form: Net sales = Sales revenue – Sales discounts – Sales returns and allowances.

What are the net sales?

Net sales are the total revenue generated by a company, excluding any sales returns, allowances, and discounts. It is a very important figure and is used by analysts when making decisions about the business or analyzing a company’s top line growth.

Is net sales the same as sales?

What’s the difference between gross sales and net sales? Gross sales do not factor in deductions, while net sales take into account all the costs incurred during the sales process. Net sales are a better measure of how much a business is making through sales.

How do you solve merchandising sales?

How do you calculate net sales in periodic inventory?

Net sales is calculated by subtracting sales returns and allowances and sales discounts from sales.

How do you calculate cost of goods sold for a merchandising company?

The basic formula for cost of goods sold is:

- Beginning Inventory (at the beginning of the year)

- Plus Purchases and Other Costs.

- Minus Ending Inventory (at the end of the year)

- Equals Cost of Goods Sold. 4