What is the journal entry for merchandise?

What is the journal entry for merchandise?

We can make the journal entry for sold merchandise on account by debiting the sale amount into the accounts receivable and crediting the same amount into the sales revenue. In this journal entry, the sold merchandise on account results in the increase of sales revenue and the increase of accounts receivable.

How do you do merchandising journal entries?

How do you record transactions in a merchandising type of business?

How do you record merchandise?

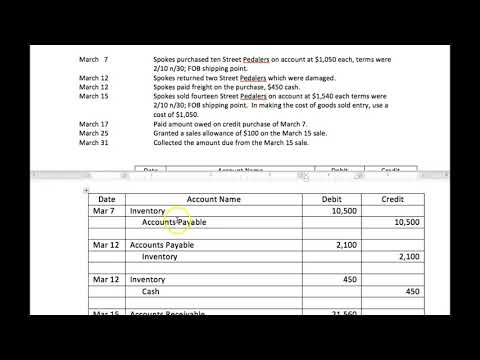

The cost of merchandise sold was $30,000. Prepare a journal entry to record this transaction. When merchandise is sold, two journal entries are recorded. This is the journal entry to record sales revenue….Journal entry to record the sale of merchandise on account.

| Debit | Credit | |

|---|---|---|

| Accounts receivable | 50,000 | |

| Sales revenue | 50,000 |

What is an example of merchandiser?

Retailers and wholesalers are good examples of merchandisers because they typically buy goods from manufacturers to market and sell them to the public consumers.

What is journal entry with example?

A journal entry is used to record a business transaction in the accounting records of a business. A journal entry is usually recorded in the general ledger; alternatively, it may be recorded in a subsidiary ledger that is then summarized and rolled forward into the general ledger.

How do you record sold merchandise for cash?

A sales journal entry records the revenue generated by the sale of goods or services….In the case of a cash sale, the entry is:

- [debit] Cash. Cash is increased, since the customer pays in cash at the point of sale.

- [debit] Cost of goods sold. …

- [credit] Revenue. …

- [credit]. …

- [credit] Sales tax liability.

How many journal entries are required for each sale in a merchandising business?

When companies sell merchandise inventory, the transaction requires two journal entries: the first entry records the revenue from the sale at the selling price and the second entry decreases the inventory account and records the expense of the sale at cost.