What is the journal entry for purchase discount?

What is the journal entry for purchase discount?

Under periodic inventory system, the company needs to make the purchase discount journal entry by debiting accounts payable and crediting cash account and purchase discounts. In this journal entry, the purchase discounts is a temporary account which will be cleared to zero at the end of the period.

How do you record purchase discounts?

The gross method of recording purchase discounts records the purchase and the payable at the gross amount before any discount. If the firm takes the discount, an account titled Purchase Discounts will be credited for the amount of the discount.

How do you record a discount in a journal entry?

Reporting the Discount Report the amount of total sales discounts for an accounting period on a line called “Less: Sales Discounts” below your sales revenue line on your income statement. For example, if your small business had $200 in discounts during the period, report “Less: Sales discounts $200.”

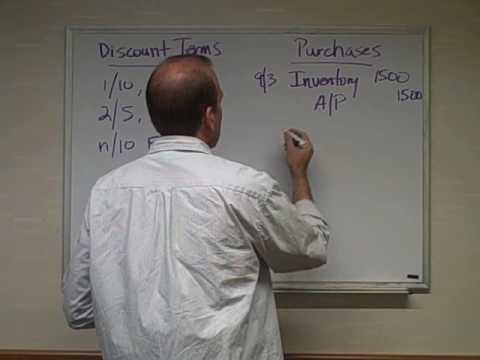

How do you calculate purchase discounts and record journal entries?

What account is purchase discount?

Purchase Discounts is a contra expense account with a credit balance that records the value of purchase cost deductions granted by a seller if a buyer makes a payment within an allowable time period, used as an incentive to encourage prompt payment of invoices.

Is purchase discount a credit?

Definition of Purchase Discount A purchase discount is a deduction that a company may receive if the supplier offers it and the company pays the supplier’s invoice within a specified period of time. The purchase discount is also known as a cash discount or early-payment discount.

Is purchase discount an income?

Purchase discounts is a contra revenue account. Revenue accounts carry a natural credit balance; purchase discounts has a debit balance as a contra account. On the income statement, purchase discounts goes just below the sales revenue account. The difference between the two results in net sales revenue.

What is the difference between purchase discount and sales discount?

Getting a purchase discount also encourages the retailers to offer sales discounts to their customers. Individual customers are not the only ones that get discounts. Purchase discounts are the reductions that retailers and stores get from their wholesalers.

Is discount a debit or credit?

Discounts. ‘Discounts allowed’ to customers reduce the actual income received and will reduce the profit of the business. They are therefore an expense of the business so would go on the debit side of the trial balance.

Why discount allowed is debit in journal entry?

#1 – Discount Allowed The discount allowed is accounted for as an expense of the seller. Hence, it is debited while making accounting entries. It has 3 major types, i.e., Transaction Entry, Adjusting Entry, & Closing Entry. read more in the books.

Is cash discount recorded in purchases journal?

Thus, cash discount received and allowed is recorded in the journal proper.

How does purchase discount work?

A purchase discount is a deduction that a payer can take from an invoice amount if payment is made by a certain date. This discount is used when a seller needs to accelerate the inflow of cash.

How do you Journalize a discount payment?

When the company elects to take the early pay discount, they would debit accounts payable for the full invoice amount, then record a credit to early pay discount and the remaining amount to cash (the early pay discount reduces the amount of cash the company must pay).

Is purchase discount an asset?

When the buyer receives a discount, this is recorded as a reduction in the expense (or asset) associated with the purchase, or in a separate account that tracks discounts.